Today, a substantial number of leading AEC firms wrote an open letter to Autodesk CEO, Andrew Anagnost, highlighting a range of concerns, but specifically pointing out years of price increases with a lack of development of Revit, a tool on which they have come to rely. Martyn Day explores the reasons why

In the thirty years we have been following the AEC technology market and the 18 years in which AEC Magazine has been dedicated to the BIM process, we have never seen the likes of this — an open letter from a community of national and international design practices venting their angst at a technology supplier. These are sizeable, mature BIM practices which include Zaha Hadid Architects, Grimshaw, Rogers, Stirk, Harbour and Partners and many more.

The letter to Autodesk CEO, Andrew Anagnost succinctly details how they:

- Have had to negotiate their way through five different licence models in four years.

- Have seen a 70%+ increase in cost of ownership of Revit licences up to the end of 2019 (with more coming).

- Are perceiving low levels of product development to the software most critical to their businesses, while experiencing negligible improvements in productivity.

- Have been forced to subscribe to ‘collections’ of non-integrated products, which are explained as high value, but in reality, do not fit with the needs of their businesses.

- Have been frustrated with Revit’s geometry capabilities for manufacture and construction, forcing them to spend even more on third-party software to fill the gaps.

- Have seen poor commitment to open interoperability in a collaborative industry, which makes them feel trapped.

- Have no clarity on the roadmap for next generation BIM technology, and have lost trust in the annually repeated promises of significant new innovations.

- Have an urgent need for cost stability and flexibility in the troubled times ahead.

Prior to writing the letter to Autodesk, the firms carried out a questionnaire on various aspects of Autodesk software development and business practices. There were nine questions in total, which the firms rated on a scale of 1 to 10 (1 being strongly disagree and 10 being strongly agree – Net promoter score).

On average, each answer scored between two to three out of ten. The answers were used to define the letter to Autodesk and agreed at director level at all firms. Some firms that took part did not want to openly sign, for fear of ‘retribution from their software supplier’ expecting dreaded ‘licence audits’ – which in itself is a damning reflection of the relationships that Autodesk has managed to foster with some of its paying customer base.

From our experience of talking with customers, all the views raised here are widely held within the BIM community and have been bubbling away for years. Autodesk customers, even the closest of competitors, talk openly to one another in business forums and have taken collective action.

To fully understand what led these firms to take such drastic action, we have to take a step back and look at the history of Autodesk’s evolving business model and its BIM product evolution. We will see that this has been a long time coming and we are at a point where mature BIM users are frustrated.

Revit, collaboration & next generation

Autodesk used to think the answer to all design problems could be found in applications based on its flagship AutoCAD drawing tool. The company developed model-based architectural design tools: Autodesk Architecture, then Architectural Desktop but these were soon eclipsed by a new kid on the block – a technology startup called Revit.

Revit was launched on April 5, 2000 and, with Autodesk’s competitors circling to buy it, Autodesk acquired the company on 2002. While Revit got off to a slow start, its message of BIM and coordinated 2D drawings eventually came to dominate in architectural practices in many geographies.

Fast forward to 2020, and Revit is now over 20 years old. In the software industry, an application is deemed old at ten years and is usually rewritten to try and make use of operating system and hardware changes.

While Autodesk has certainly added to the product’s capability and fleshed it out over 18 years, its core engine still predominantly only uses a single CPU core. This is an issue when modern day processors tend to boost performance by adding cores, not by increasing clock speed.

While a select group of more recently added features will utilise multiple cores and threads, the Revit engine has been showing its age for many years now. Similarly, in the world of graphics, basic features like occlusion culling were only added in 2017.

The main oxygen for Revit users is to load up on as much RAM as possible and cut up models before they become too much of a drain on performance.

In the past, releases that have managed to give more performance, have quickly been eaten up with larger models, or more detail. Here, in this letter to Autodesk, the most mature and BIM-capable practices are expressing what we see as industry-wide frustration in the lack of an underlying modern software architecture.

In moving from big ‘R’ releases to bi-annual subscription feature updates, Autodesk has also not helped itself by dissipating the delivery of its development work. Updates appear in the March and September time frames and the drip feed of features adds to the feeling that Revit is in something akin to maintenance mode.

The key point here is Revit should have had a fundamental bottom-up rewrite a long time ago, either in stages (such as with products like Nemetschek’s ArchiCAD) or as a whole new codebase. If any software firm were to develop a BIM tool from scratch today, or even five years ago, it would not have the underlying software architecture of Revit – CPU, GPU optimisation or database structure.

We don’t think Autodesk has been oblivious to this fact and in years gone by we had conversations with Autodesk team members about whether Autodesk’s next generation BIM tool would be based on Fusion 360 (Autodesk’s manufacturing CAD tool) and cloud.

At the time, and still true today, the cloud was seen as the future. One Autodesk exec explained to us several years ago that the idea of writing a Mac version would be very short lived, as any future rewrite would leverage the cloud and if it worked in a browser, it would run on any operating system or machine. But five/six years on, that cloud version is not yet available, and the reality is, that mature users continue to push Revit to its limits and are spending time and effort working around its inherent limitations.

The letter to Autodesk highlights the fact that cost of ownership for enterprises has gone up considerably. Development has not matched expectation of expert users and practices want a BIM tool that utilises the multi-core CPU workstations they have been buying for the last five years, to get better productivity, create bigger models, add more detail and require less workarounds.

Collaboration in the AEC industry isn’t just important; it’s essential as there is not one product or platform that can do everything. Despite inventing the Industry Foundation Class (IFC) methodology for data interchange, which is now an open ISO standard, Revit’s coherence in IFC import/export is widely ridiculed. Customers are also fed up with incompatibilities in data exchange within Autodesk’s own portfolio of products, as well as with other important industry players.

The letter to Autodesk mentions lack of clarity on a roadmap to deliver next generation tools. In 2016 Autodesk did announce it was developing a cloud-based BIM design tool for the AEC industry, codenamed Project Quantum but that vanished and then reappeared as Project Plasma in 2019. However, nothing has been heard of that publicly for over a year. It does appear that Autodesk’s reluctance to invest in re-developing Revit’s core could be because a new generation is in development.

AEC magazine has championed the coverage of this exciting development but there seems to have been significant delays and we aren’t 100% convinced that the Revit team is actually doing the development work. We will return later to this topic within the article.

Sales, prices and licences

The letter to Autodesk clearly lays out the pressures practices are currently experiencing. Since the move to subscription, Autodesk has been ratcheting up the cost of ownership considerably. In the last five years, the signatories of the letter have assessed that a seat of Revit has gone up 70%+ and with Autodesk’s planned licence changes this year will increase further.

This move to a pure subscription business has been inevitable since 2013 when Autodesk offered its first subscription alternative after it had long admired Adobe’s move to online subscription, removing distribution and channel margin, and connecting directly to each customer.

With the move to pure subscription, in 2016 Autodesk stopped selling perpetual licences. Over the last three years Autodesk has been increasing the cost of maintenance to perpetual user base – 5%, 10% and then 20% per annum with incentives to switch to subscription. Now in 2020 Autodesk is delivering a coup de grâce beyond price coercion to drive companies away from their perpetual licences, stopping maintenance support completely for perpetual software.

While not withdrawing their right to use the software in perpetuity, as per the EULA (End user Licence Agreement), it is looking to render their licences useless in the long term with no future updates or patches. In August 2020, the company will also be removing network sharable licences and insisting on firms having a copy per user (named user), culling multi-year discounts and putting an additional price on CAD manager-level insights to user metrics.

We have heard repeated stories of aggressive Enterprise Business Agreement (EBA) sales, which harness the fact that Revit is a de facto standard in many countries, is a proprietary format, and is not backwards compatible between releases. Autodesk is also confident that the barrier to move to one of the few other BIM tools is high.

When firms move onto EBAs they give up their perpetual licences, making it impossible to go back. After being encouraged into an EBA, possibly on a three year discount, the customer has a lot less negotiating capability next time around, as all the seats would need to be repurchased (re-subscribed) at fixed non-discounted prices. Some firms like HOK walked away from their EBA renewal.

Another contributing factor to the writing of this letter would have undoubtedly been recent changes to future licensing. Autodesk is removing the multi-user network (concurrent) licences and instituting named licences. Every user must have their own license, and sharing is not allowed under the EULA. So, you cannot have a single machine running a licence that a number of people might use throughout the day or week.

Autodesk believes networked licences are typically shared between two users – but from talking to AEC firms we feel the reality might be more like four users to one licence.

If a user chooses to trade in their network licence in Autodesk’s time frame, they get two licences for the price of one under subscription for eight years. However, if a customer decides to not trade in their network licence, they have to pay an additional 20% in maintenance in order to renew their licence for another year. After that, Autodesk will not renew the maintenance and customers are faced with buying a new subscription for every user at normal prices or use the software without any future maintenance. This is clearly a way to force more subscription seats into customers and there appears to be no obvious benefit to customers in the removal of network licences.

Licensing is probably an article in itself. It’s a convoluted mess. Perpetual, subscription, Suites, Collections, single user, network, named, maintenance, Token Flex, and crossgrades. The individual circumstances of any Autodesk customer will be a licensing voyage in its own right, together with Autodesk’s policies in seemingly never-ending evolution.

Customers are currently running serial licences and named licenses as Autodesk again implements another transition. This makes licensing difficult to manage for any large practice. Indeed, in the Q4 FY 2019/20 call to investors, Autodesk CEO, Andrew Anagnost admitted, “They’re [customers are] living in what we’ve affectionately call [sic] hybrid hell inside the company where they’re trying to manage two types of different system [licence systems].”

Autodesk customers will be more than aware that Autodesk is hot on anti-piracy and has a team devoted to ‘non-compliance’, yet the products themselves come with very little in the way of management tools to help firms be in complete control across an extended enterprise.

The Autodesk software audit is feared amongst both software pirates and the IT directors of paying customers. A whole industry has grown up around licence management tools to try and maintain control and protect firms from aggressive audits from their software providers.

In fact, some firms told us that they chose not to sign the letter for fear of ‘commercial reprisals’, namely audits looking for infringements and associated fines. We would suggest that Autodesk in its valid search for true piracy has damaged customer relationships in the process.

The forthcoming changes to licensing, i.e. the move to individual named licences, which come with basic management tools are all coming this year (the ‘Pro’ level named licence analytics are available for an additional fee per seat). Autodesk states that this will help sort out the ‘hybrid hell’ which they created for customers. However, all of this comes at additional cost, which the letter points out is already an issue, plus a loss of network licencing.

The additional upside for Autodesk is that named user licencing also gives Autodesk access directly to the names and desktops of every user, in every company, and information about how they use the software.

Data ownership and cloud

Good faith is important between a client and a customer. It’s even more important in subscription and SaaS models. When business practices that include price-coerced licensing upgrades and crossgrades result in rapidly increased cost of ownership, IT directors feel helpless. In addition, when all project data is held in a proprietary format, on servers owned by a company with a poor record of open standards, epic levels of trust are required.

The letter also highlights the fear of what will happen to customers’ data and IP when on Autodesk’s cloud, as well as some general concerns on performance and reliability of BIM 360.

Anagnost, Vision and R&D

The open letter is addressed to Andrew Anagnost, CEO of Autodesk since June 2017. Prior to the CEO role, Anagnost was instrumental in developing and rolling out the move from perpetual to subscription model and was a core executive team member in Autodesk’s Oregon mechanical CAD team.

In changing the business model, Autodesk has gone from a typical stock price of $40 to $60 per share under previous CEOs to around an incredible $240 a share (62% up from March 2020, at the time of writing this article) a move that has taken the company from $2 billion in annual revenues to almost $3.3 billion.

Under Carl Bass (Autodesk CEO, 2006 – 2017) Autodesk had somewhat of a ‘Cretaceous period’ with lots of new product development and code streams. On taking over in 2017, Anagnost immediately started culling a lot of software development that was not core to the business or was not making money.

Autodesk’s product development was streamlined by priority, to software that was currently selling and mature (e.g. Revit, Inventor), emerging software (e.g. Fusion 360 and BIM 360), and then next generation technology such as Project Quantum. This changed the company’s R&D dynamics and we saw a huge investment in cloud and construction.

When Anagnost got the CEO role, AEC Magazine interviewed him at Autodesk University London in June 2017 over a video link. We pointed out that with Autodesk subscriptions, there is an issue. Products like Revit have not met the expectation of companies that have invested in them.

With the announcement that Autodesk was no longer selling perpetual licences and was requiring enterprise customers to exchange them for multi-year Enterprise Business Agreements (EBAs) we suggested that Autodesk was asking customers to pay more for something they were already unhappy with the value of. “The price hikes have been so big that they (customers) can’t quite believe it,” we said.

In response, Anagnost explained that Revit still had a long way to go in terms of possible development and that Quantum (next generation collaborative BIM) was in the same continuum. He agreed that the maintenance base was struggling with pricing, explaining that users were asking “what’s going on?” and “where is the value?”

“I talk to them and I even call the one-man shops, as well as the big guys, and I say this consistently: I understand and I want you to give us a year to prove to you that we are delivering value, don’t leave us,” he said.

In the interview, Anagnost conflated the AEC industry with happy customers from the manufacturing (MCAD) industry, especially those using the new code stream product Fusion. However, at the time Fusion was a $50 per month wannabe product which aimed to compete with the market leader Solidworks, after Autodesk had failed to dominate with Inventor. In contrast, Autodesk was dominant in AEC and BIM but customers had their data in Autodesk’s proprietary BIM formats.

In 2018, following continued conversations with readers, we used the Autodesk University press conference to call out the unhappiness within Autodesk’s enterprise AEC customers. Anagnost jokingly replied “Fake News”.

We then had a meeting in which Anagnost explained that some customers were unhappy because it had not been properly explained that big discounts had been applied to their previous three year deals because they had surrendered their perpetual licences for subscription licences.

We relayed that firms were telling us of sales meetings with Autodesk in which no negotiation on price was being entertained, consultancy inclusion was mandated and they were warned that not signing the EBA would involve firms having to subscribe all the licenses at the market rate.

In 2019, things had not progressed and we raised the issue again in a direct communication with Anagnost. In our exchange, Anagnost explained that Revit’s development was still ongoing and that MEP and generative design will be key development areas (this came to pass in the recent Revit 2021 release which included generative design (although only for subscribers of the AEC Collection).

Anagnost admitted that the company’s investment in development had shifted from ‘A’ (Architecture) to ‘E’ (Engineering), ‘C’ (Construction) and ‘M’ (Manufacturing), with the majority of the money going to the “C” and the “M”.

In 2018, Autodesk spent $875m on Plangrid, $275m on BuildingConnected, as well as an undisclosed amount on Assemble Systems (amongst others). It was the biggest acquisition year in Autodesk’s history. In the last two months, Autodesk has acquired Pype, a US firm that uses AI to automate construction project management workflows, and made a $7m investment into Bridgit, a workforce planning software firm.

The construction space and cloud (SaaS) have become an obsession for Autodesk as it fights Procore, Trimble, Oracle and seemingly Uncle Tom Cobley for the right to be the data platform for (initially) the US construction sector. Anagnost told AEC Magazine that architecture development was not being ignored but had been pushed out to a multi-year development effort.

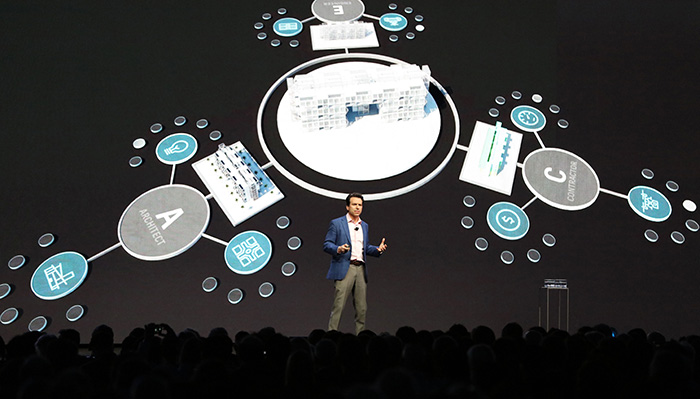

The next generation of BIM tool, Project Quantum, was announced in 2016 by the then senior VP of products at Autodesk, Amar Hanspal. It was renamed Project Plasma in 2018, and now has a third unknown name.

Anagnost was obviously a big fan of Quantum, having highlighted the concept in his keynotes at Autodesk University in 2017 and 2018. But, in terms of development, he told AEC Magazine last year that it was most certainly not where he wanted it to be. Anagnost explained that he found out it had been announced before Autodesk had a defined and functioning data layer. From the Autodesk Q1 FY 2020/21 investor call, it now looks like we might see something more solid at the virtual Autodesk University in November 2020.

The letter might not come as too much of a shock to Anagnost, as he has openly admitted that architecture development has seen a reduction in investment, and has been stretched out over a number of years on his watch.

However, the cost of Revit ownership to Autodesk’s AEC base has seen a 70%+ price increase per seat in five years, for limited development. In our discussions with Autodesk customers, they feel the Collections (Suites) are stuffed with applications they don’t want or use. Instead they just want development to focus on their core BIM tool Revit. This November, it will have been four years since the idea of Quantum was originally shared publicly, and the deployment of a full next-gen BIM tool is still seemingly a number of years away.

Conclusion

In the world of business, looking at the current Autodesk share price and the increase in revenues (up 61% FY 2017 to FY 2020), Anagnost is a great CEO. There will not be an unhappy investor on the planet with those kinds of returns. Sales up, income per user up, margins up, with an aggressive laser-focussed acquisition strategy for organic growth.

In many ways, in terms of business execution, it’s back to the days of Carol Bartz (Autodesk CEO 1992 – 2006) who put shareholder value at the top of the line and grew the company to its first $ billion, although that was somewhat painful with AutoCAD R13 happening soon after she joined.

The problem is that Autodesk’s short-term business objectives have seemingly taken priority over the long-term software development of the AEC flagship tool, Revit, while customers have seen significant increases in their cost per seat for little productivity benefit.

With almost annual coercion to move some element of their licences to please Autodesk’s business model, large customers are fed up with being herded around and feel like hostages in a Kafkaesque relationship.

Autodesk is undoubtedly ‘squeezing the lemon’ hard for its mature BIM customers and in this new subscription world, positive ongoing customer relationships are key. The letter states it clearly: customers want price stability, licence model stability, significant development of their core tool and they don’t want to feel like hostages.

Audits make them feel like software pirates and non-compliance is a growth division for Autodesk revenue. There is also a lesson here for customers, especially those at board level, in that not telling visiting VPs and CEOs of software providers exactly how you feel about development and costs on any visits, gives a false impression. If a company is using the business language of ‘partnership’ in its marketing, explain what reciprocal effort is required on their behalf.

The reality is that when Anagnost was promoted to the position of CEO, Revit was already overdue significant rework. The transition to cloud in AEC has also not been as straightforward as anyone in the software industry had originally envisaged.

Kicking Revit’s re-development into the long grass and focussing on spending a vast sum on cloud for building contractors seems somewhat of a parochial retrograde vision for a future where a model-centric BIM could drive digital manufacturing and off-site processes.

Increasingly, leading BIM-based architectural design firms are seeing Revit as a painful way to get 2D drawings. It’s not the front-end conceptual design tool of choice for complex geometry projects, just part of the documentation process. When they ask for new features or specific capabilities many of these firms are tired of hearing, ‘use [computational design software] Dynamo to develop it yourself’.

Autodesk is much more likely to add in capabilities to please all users, than cater to the needs of architectural practices that are really pushing the boundaries of form and looking towards digital manufacturing.

The open letter is certainly born out of frustration, from firms that have invested so much time, energy and money into Revit and Autodesk products but now feel limited by these tools. These firms should be the key cheerleaders/fan boys and marketing partners to promote industry change to model-based design and onto digital fabrication.

It will be interesting to see how Autodesk reacts and if it makes any cultural changes to address its now vocal, frustrated, advanced BIM user base. We are certainly seeing much more experimentation with other CAD and BIM authoring tools such as ArchiCAD, Catia, BricsCAD, Rhino/Grasshopper, Rhino Inside, BlenderBIM and others, driven by a number of factors. Practices are seeking better value for money and not just as alternatives to Revit but also to advance their digital design and fabrication workflows. Mature BIM practices want to progress onwards and not feel like they have gone into a BIM technology cul-de-sac.

If you enjoyed this article, subscribe to our email newsletter or print / PDF magazine for FREE