Once a year Autodesk holds an event for its customer to come and learn about the tools they use every day, to hear about future plans and see forthcoming technology in action, including the new 3D tools scheduled for the next release of AutoCAD.

Now in its 13th year, Autodesk University (AU) is the company’s annual week-long event for global customers, held in the USA. Recently there was an Autodesk University here in the UK which was a one day event; the two can’t really be compared. Autodesk holds AU at the end of each year, a good four months before it traditionally launches new product. The main reason for this is that, as the name University would imply, it’s all about learning.

While there are keynotes, beer and schmoozing, the real backbone of the event is the extensive program of courses that are run in all major engineering disciplines, from CAD users to CAD managers.

AU has been traditionally held in Las Vegas, but this year it moved to Florida, in the heart of Mickey Mouse territory – from an adult’s playground to a child’s. The move benefited the attendance numbers, with over 5,200 Autodesk customers and partners showing up for the event. The boost in attendance now means AU will be alternated between Las Vegas and Orlando over the coming years.

The site for AU was the Dolphin hotel, which operates in tandem with the Swan hotel, both designed by Graves and equally surreal. Walking around the grounds the day before the event, Autodesk’s marketing had clearly gone into overdrive, specifically concerning DWF. In the lakes connecting the two hotels there were a number of big red DWF balls floating about and the path between the hotels was punctuated by flat circular ‘stepping stones’ which told attendees to ‘connect the dots’. DWF marketing had quietened down this summer and Autodesk’s on-going spat with Adobe seemed to be cooling. It seems the summer was just a lull in the fighting. At this year’s AU, DWF was everywhere. In fact the first function I attended (by accident) was the launch of the DWF developers network, which was held in a marquee near my hotel. Autodesk has big plans for DWF and I would see more of this in the main stage presentations.

AU wouldn’t be an Autodesk event without gossip and the first hoo ha was Autodesk’s door policy, locking out competitors, such as Bentley and Evan Yares of the Open Design Alliance (ODA). This happened despite me seeing Autodesk employees attend other vendor’s events in the past. With Autodesk’s dominating position in the market, one would think it had less to lose here but I think this is indicative of Autodesk fostering a new aggressive culture. In the last couple of years we have seen SolidWorks release DWG ‘editors’ based on Open Design Alliance clone technology, as well as forward/backward DWG translators and free DWG viewers from companies like Bentley.

Within the year Autodesk has hit back at all these, giving away a free DWG viewer again, creating its own free DWG translation tool to rival DWG Gateway and even found time to produce a DWG engine, called RealDWG, for developers Autodesk likes (at an unusually nice price). Most of SolidWorks and Bentley’s DWG-based products are based on clone technology supplied by the ODA, so it’s perhaps unsurprising that Evan Yares, the CEO of the ODA would not be let in.

Autodesk has been busy plugging the gaps that the competition has tried to make, countering future threats and is still growing at the meteoric rate of around 30% per year. The company is clearly ‘on a roll’ and has adopted a zero tolerance policy to competitors, and since Autodesk ‘verticalised’, it has a lot of competitors.

Keynotes

The main event is the keynote session. This is where the company execs get the chance to talk to their customers and wow them with new vision, strategy and technology. The first thing you noticed this year on entering the hall, is the sheer size of the room required to accommodate over 5,200 customers, it was like an airplane hanger. The second thing you noticed was the presentation screen. Autodesk has always produced good stages but this year’s was, I have to say, unbelievable. The screen ran the entire width of the room and was powered by many overlapping hi-definition projectors. This was cutting edge display technology!

" It’s impressive to see that there is a strong intent to unify Autodesk’s wide variety of solutions and have all these huge development teams work within a well defined standard framework. "

First to the stage was Autodesk’s long-term CEO Carol Bartz, who was on-form for the crowd. She welcomed the audience and thanked them for using Autodesk solutions, she also noted that it was the 13th AU and apologised again for Release 13. The Autodesk motto, Create, Manage and Share got another outing, as Carol ran through the current product offerings, with a special mention of DWF and how it is in all Autodesk products and will be become increasingly powerful, leading to a claim that finally we will see digital design data replace paper. Autodesk sees that the millions of users of engineering data need access to the data within digital models. Carol also spent some time encouraging 2D users to ‘transition’ to the vertical products.

In previous year’s events, the next slot would be Autodesk’s Chief Technical Officer (CTO), who would give some demos of cool features of forthcoming products, namely AutoCAD 200X. This year Autodesk is without a CTO, a role that appears to have been absorbed by Chief Operating Officer (COO), Carl Bass, whose reappearance at the company seems to have coincided with a boost in product innovation and revenues. Carl took to the stage having obviously sat on one of the luminescent green flyers that had been placed on every chair in the hall. I say obviously because it stuck to his behind as he took the stage much to the amusement of the audience and Carl Bartz who he was handing over from.

Carl’s pitch was to look at the technology trends that companies were following because of business pressures; bringing products to market quicker, cheaper, on a global level. Carl said these pressures were causing traditional boundaries to break down and design data has to flow smoothly, not letting digital assets become analogue, become paper, and get dumbed down. Carl explained that he thinks the solution is to connect across multi-disciplinary boundaries, creating a seamless process. Stoking the Create, Manage, Share fire that Carol started in her keynote, Carl summed up the trend as ‘convergence’.

Carl stated that the first stage of this is for firms to adopt a model-based approach to design, not so much in the 2D to 3D benefit, but in the ability to see the behaviour of the model on the fly, through real time analysis. Also changes made to the single model, automatically update the views or 2D take-offs. This has been made possible by advances in network bandwidth, processor speed, PCs with multiple CPUs, multiple cores, high-end graphics processors doubling in speed every 12 months and lower costs. As a result, it’s now possible to do much more within software.

These models are much more valuable as they mirror the reality of the objects we build in the real world. The challenge is to design software to make it much easier to design more complex models.

Instead of a feature by feature presentation of ‘new stuff’, Carl and his team put together a presentation based on this idea of convergence between Autodesk products, engineering data and at the same time included some hidden sneak peaks at new functionality and a few completely new products. Using the hi-definition screen to its full potential, the team worked around a fictitious bubble wrap company that was expanding and introducing new technologies. Working in-turn through each discipline, I did feel this could be a tough trip for the audience of mixed users but the quick fire approach to working through the example ended up leaving a positive image of the vision that Autodesk was working on delivering in the future.

Essentially the demo included most of the usual suspects (Inventor, Vault, ProductStream, AutoCAD, ADT, Revit, Buzzsaw, Civil 3D, MapGuide, DWF) working on designing new machinery, plant, facilities, buildings and co-ordinating data across the project. The first thing that this drives home is just how many products and brands Autodesk now has. Since verticalisation, Autodesk’s product offerings and capabilities have mushroomed. The only areas Autodesk doesn’t compete in are Process and Power and in a conversation with Carl Bass later in the event, he acknowledged that Autodesk had every intention to play in those vertical markets as well; the words global and domination came to mind.

I’ll cover the AutoCAD related technologies later on, but two interesting products on show were Toxic – an amazing post rendering utility and a VR environment that used multi-core, multi processor systems to render absolutely gigantic VR environments. Toxic is near to or is shipping and allows you to significantly alter rendered images without having to re-render the whole scene. Having used many renderers, it was almost unbelievable and probably used an insane amount of memory and processors, altering the focus of the camera lens in real time, without having to re-render the scene.

I didn’t catch the name of the VR tool but Ralph Grabowski of www.upfrontezine.com thinks the name could be ‘Northland Render” and he describes it as “a file viewer with an all-encompassing file format”. Carl Bass was explaining on the main stage that this tool could import data from a wide variety of systems or file formats. The view started off looking at one piece of plant in a room, then slowly zoomed out to display three copies of that plant within the space. Then zooming out further we travelled outside the walls to see the building, which was created in Revit then the building compound, the city, sea and surrounding landscape. All of this was from repurposed CAD data, which is a lot heavier than games-based interactive data, and the massive data models were manipulated and displayed in real time. There was a strong running theme that Autodesk wanted to use the new hardware that was out there, such as dual core, to really push its vision and deliver applications that would use up the spare CPU cycles.

New marketing

Talking with the PR folks at Autodesk and seeing some pretty provocative posters pitching Inventor (Autodesk’s core Mechanical CAD product) against SolidWorks (Autodesk’s main competitor), Autodesk looks set to go on the offensive in key target markets. AutoCAD, LT and ADT all seem to sell themselves. Sales of all those packages have been double digit growth for a number of years. Autodesk wants to concentrate on markets where it has bigger fish to fry, namely SolidWorks (owned by Dassault), ESRI in geospatial and Bentley in Civil Engineering. SolidWorks has been a knife fight for a long time but ESRI and Bentley compete in installed base. While the applications of Bentley and ESRI may dominate a specific landscape, AutoCAD is still endemic as the 2D drawing tool. This offers Autodesk the chance to sell-up those seats with new offerings, such as Civil 3D. To enable some of this, the next AutoCAD will include support for Bentley’s DGN (V8) read/write, which Autodesk reverse engineered.

AutoCAD 2007?

Before showing any of the new technologies, Autodesk put up a disclaimer stating that it didn’t promise to include any of the technology demonstrated in forthcoming products, but it’s not too hard to figure out what goes where and how advanced in development the software was.

From talking with Autodesk execs, the next release of AutoCAD (due roughly at the usual time around March) should include support for DGN and Adobe PDF. The inclusion of PDF is an interesting one. Autodesk and Adobe have been at each other’s throats for a couple of years now, battling to be the format for publishing engineering data. PDF got in through the back door, as PDF already enjoys wide-spread use in our industries but when Adobe’s marketing targeted the engineering and architectural base, Autodesk fought back with DWF and counter-marketed. The inclusion of PDF has been at the top of the AutoCAD User Group wish-list for a long time now and putting it inside AutoCAD could well counter the DWF message. However, we don’t know how well Autodesk will implement PDF, the depth of functionality etc. It also could impact Adobe Acrobat Professional sales as with 7 million legal users and an estimated 30 million illegal users of AutoCAD, it’s the main market for Adobe. I think Autodesk is confident that DWF is a better format for engineering CAD data and having both in the box will help expose customers more to the benefits of DWF.

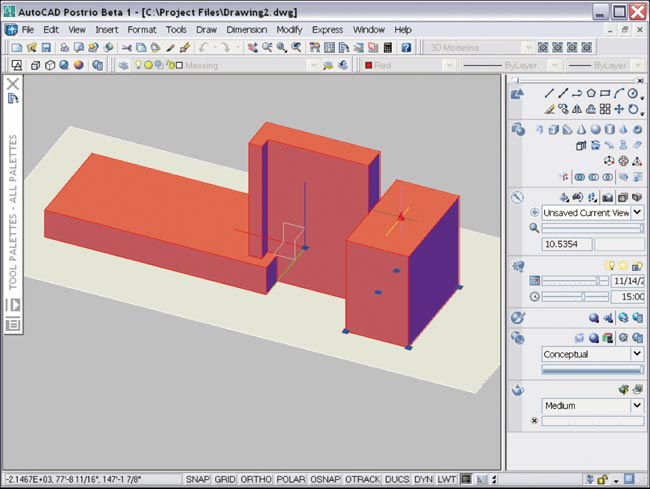

There will be a whole raft of 2D enhancements, as you would expect, but the next AutoCAD will all be about 3D, conceptual design and presentation. These aren’t traditional big pulling areas for AutoCAD’s installed base which is predominantly 2D. From its questionnaires, Autodesk believes that 50% of the installed base uses 3D in AutoCAD. I can’t quite believe this from my experience of meeting with customers. That point aside, I can’t argue with the way that Autodesk has implemented the new 3D tools.

AutoCAD looks to now offer a dual interface; the ‘classic’ for 2D design and a 3D interface for the new 3D tools, so no need to worry about losing familiarity. In fact the new 3D tools work in the classic interface too, should you wish but the new interface looks clean and easier to use. It’s obvious from what I saw that Autodesk has included much of the look and feel of 3D Studio Viz, together with the now defunct Architectural Studio, as well as borrowing many ideas from the excellent SketchUp conceptual design product.

2D sketched outlines are simply grabbed and with a right-click they can be extruded into solids on the fly. The product features powerful sweeps and lofts, grips, Booleans, Helix, dynamic UCS, 3D grid plane, sun study tools, artistic lines styles and a range of primitives. There are also rumours of a new rendering engine, although nothing was demonstrated. The new features appear to be remarkably easy to use and powerful, considering they are included in AutoCAD, and anything created in the new modeller can be imported into Autodesk Inventor as it uses the same ShapeManager Kernel. However, even with these tools, vanilla AutoCAD will still be nowhere near as powerful as Inventor as it doesn’t handle geometry relationships or assemblies; it’s simply about creating shapes, easily. As you might expect, the 3D features will not be added to LT, furthering the divide between the products.

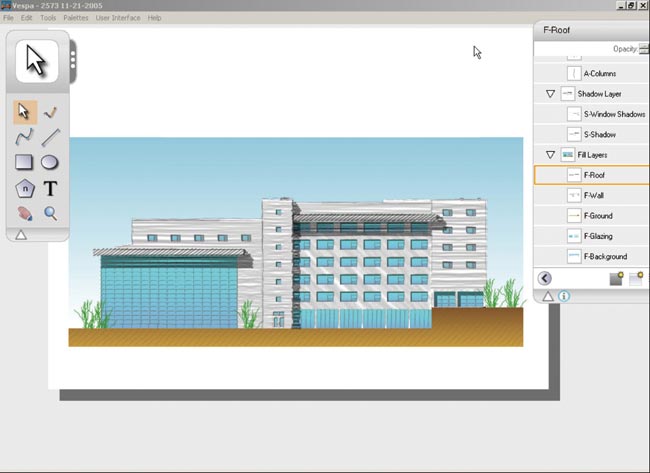

Vespa

The codename for a brand new product from Autodesk, developed in response to customers requesting a tool to artistically enhance their 2D drawings. Many folks take 2D planes, sections, elevations or ISOs and use products like Photoshop to augment the CAD image to make it look either hand drawn or more interesting. Vespa looks to be an inexpensive way to achieve some of these goals using some smart short cuts. Again some of this technology appears a little like Architectural Studio technology. Despite Autodesk’s best efforts to make Vespa’s output look truly awful, a quick demo shows that there is no talent button and in the right hands Vespa could actually be a very useful tool. The ability to substitute AutoCAD elements like circles for tree cells and grass texture for specific hatches, means that any updates to the original drawing will be automatically updated in Vespa, reflowing with the new hatch layout or populated where circles have been moved or added.

DWF

With now over 10 million downloads, Autodesk is very happy with DWF’s acceptance within its installed base and is looking to push its usage out to the engineering data consumers. The launch of the DWF developer network and further planned expansion of the format should lead to a life outside of the traditional Autodesk customer. As I’ve said before DWF is almost a DWG light, as opposed to a dumb web format and can contain important meta data about designs which can be interpreted. Autodesk is hoping the new third party developers will take DWF and develop applications which can leverage the benefit of the information they contain. Possible applications appear to be quantity surveying, facilities management and on-site maintenance reference. I think this will be a very interesting area to watch as data is staying digital for longer and can be of more use when used in combination with a smart light-weight application.

Subscription

Autodesk’s subscription model largely remains unchanged year on year. Essentially, paying for a subscription just gives you the next release of AutoCAD, some on-line training and web-based support (that’s actually integrated into AutoCAD). It appears that Autodesk is looking to enhance its Subscription program by providing more content and information within the yearly timeframe as part of the deal.

Autodesk’s last clump of major upgraders, AutoCAD 2002 users, have had a small stay of ‘execution’, with the obit being moved to March, which just happens to be Autodesk’s first quarter of the financial year. After 2002 there were no great chunks of users upgrading their AutoCADs as Subscription has smoothed out that revenue. It just so happens that by being on Subscription it also works out cheaper than upgrading any other way i.e. every other release or longer. Funny that, isn’t it?

" Autodesk is projecting a coherent vision and a strategy across its market divisions, while targeting some key and sizable competitors. "

AEC and Infrastructure

Most of the focus was on the relatively new products of Revit Structure and Civil 3D. ADT is pretty much selling itself these days and Revit Building continues to be slow but sure. The difference between the two products seems clearer now Autodesk isn’t really pushing the 3D capabilities of ADT particularly hard these days, ADT is document centric in a familiar AutoCAD environment, whereas Revit is model based and a new way of working. The Revit Series, a bundle of AutoCAD and Revit Building, is apparently selling well, with many copies going into China, and actually used in production, so I was told. With these customers owning Revit, but probably not actually using it, Autodesk is recruiting local evangelists to go to customers and help them unlock the benefits of Revit post sale. It’s a testament to bundling incentives and Autodesk’s channel that they can sell something that’s not obviously going to be deployed or used. It also proves that a box sold, does not necessarily mean there has been a technology adoption. In the architectural world moving to a model-based approach is going to be a long hard slog.

This probably isn’t going to be the case in the Civils market, where the benefits of using a model-based approach are much more apparent, although a lot of work is still being done in vanilla AutoCAD and LT. Autodesk has arrived late to market with Civil 3D and it certainly has a long way to go before it’s completed. I asked Autodesk’s VP of Infrastructure Solutions Division, Chris Bradshaw what the strategy was behind Civil 3D? Chris replied, “We see more and more engineering design firms becoming multi-discipline. The industry is consolidating and the demand from customer is to have one stop shops, capable of doing anything from an airport to a car park. Civil 3D is a platform for a standard solution for multi disciplinary companies. If you want to do basic roads you can do that in Civil 3D, however, if you want to design highways/motorways or rail, Civil 3D is the platform that allows interoperability, but you’d need an extended solution, for tunnels, bridges etc. This will be a family-based offering built on top of the foundation product, so we’d produce Civil 3D Rail, Civil 3D Bridges etc.” We reviewed Civil 3D in this month’s issue, turn to page 18.

Conclusion

The diversification of Autodesk’s market spread continues as the vertical products mature at an impressive rate. The talk of convergence is an interesting counter point to the direction of the vertical market divisions, which are catering to different user requirements, and different industry needs. It’s impressive to see that there is a strong intent to unify these solutions and have all these huge development teams work within a well defined standard framework. Early on in the verticalisation of Autodesk, the products started to drift apart from one another as the teams headed off down different technology paths and interoperability between Autodesk’s own solutions suffered. This is now on the mend.

In fact, the technical competence and product management of Autodesk’s portfolio has been dramatically enhanced over the last few years. While Autodesk hasn’t been the most innovative of companies, there appears a greater willingness to create new products and address emerging markets. In several key markets, Autodesk is, or has been, on the back foot and the company now appears to revel in taking on sizeable competitors, both technically at the product level and now with aggressive marketing.

Next year we will go through a 64-bit, expanded memory, multi-core, multi-processor revolution. We have gone through a couple of generations of Pentium processors that provide more horsepower than most need, but many users have been mainly hitting the meagre memory limitations of 32-bit Windows. The next generation of Windows operating system, Vista, with current workstation architectures will provide 16GB and upwards of addressable memory, which is proving to be a major incentive for CAD developers to quickly port their products too. From the AU presentations it’s clear that Autodesk is also looking to make use of the enhanced processing power that’s also out there, to deliver even more powerful model-based applications.

The technology demonstrations for the next releases of the software look really great, although I’m sure the inclusion of better 3D in AutoCAD will not be massive ‘puller’ for the installed base – well, not immediately. Hopefully users will get intrigued to play with the conceptual tools and easy-in 3D front-end. The challenge will be getting real benefits out of using it. I’m guessing Autodesk will hope this taster of 3D will get users to cross-grade to Revit or Inventor sooner rather than later.

In short, Autodesk is, and has been, delivering at the product level and the trend looks set to continue and perhaps even accelerate. Autodesk is projecting a coherent vision and a strategy across its market divisions, while targeting some key and sizable competitors. The company appears to be making aggressive moves in the markets that it’s trying to get into and now playing a careful defensive strategy in areas it already dominates, with more markets to come.

The key challenge now for Autodesk is to build relationships with its existing customers and get over the resentment that the obit strategy of AutoCAD has generated. While the products have improved greatly, subscribing to products you can’t deploy due to project limitations or just plain don’t want to upgrade your CAD system every year, does not help drive an appreciation of the value customers are getting for their subscription money. The only other threat I can see is if some company, with a decent brand, were to target the sub $1,000 market with a competent 2D or 3D drawing tool. LT costs a lot of money here in the UK, when compared to the US, although that doesn’t seem to have stopped sales growth yet. Next year should be very interesting for Autodesk.