Over the last few years it’s all gone a bit quiet on the marketing front at Bentley Systems. Martyn Day caught up with Tony Flynn, Bentley’s VP of marketing, to find out exactly what the multidisciplinary AEC and infrastructure CAD company has been up to.

![]() What’s your view on the AEC technology market today? What are the key trends?

What’s your view on the AEC technology market today? What are the key trends?

Tony Flynn: I’m more excited now about the infrastructure market than ever. Engineering News Record (the US-based construction industry magazine – Ed) is predicting over $4 trillion in construction for next year. There is much to improve in the world. And software for infrastructure can do much to help. Here, I see four main advances.

First, general-purpose CAD is morphing and upgrading into specific disciplines. For example, CAD for architecture is becoming BIM (Building Information Modelling), which is boosting productivity and collaboration.

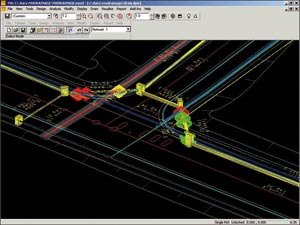

Second, products are becoming more integrated and interoperable, which is increasing quality and decreasing data loss. For example, the convergence of design and structural analysis enables building designers to simulate their designs and increase quality. The same holds true for water networks. Another example, the convergence of CAD and GIS results in fewer data translations, and therefore cuts data loss and expense for utilities, communications companies, cities, and others.

Third, software servers are taking collaboration forward by quantum leaps, cutting costs and improving performance. And that’s particularly fortunate, because most infrastructure work is now performed by distributed enterprises which must tap and connect top talent from multiple locations, often around the world.

Lastly, enterprise subscriptions for software and training are creating much more agile organisations. By removing many administrative barriers, these organisations are realising just-in-time productivity increases and more quickly responding to project needs and opportunities.

![]() Where would you place Bentley’s position in the market vs. its competitors? (key differentiators, unique selling points, customer profile).

Where would you place Bentley’s position in the market vs. its competitors? (key differentiators, unique selling points, customer profile).

TF: Bentley is in a very strong position, and getting stronger. We’re the largest software provider focused on the infrastructure market. More than 80% of the Engineering News Record 500, more than ten of the “UK Architecture 15”, and 47 US state DOTs now rely on Bentley products. And Daratech recently ranked us #1 in revenue in 14 categories of plant software.

We are in first or second place in each of our verticals: building, civil, plant, and geospatial – a testament to the strength and advantages of our solutions over other choices.

In building, for example, we offer a single, strong BIM solution for architects, A/E firms, construction companies, and owners. The other choice is Autodesk, which does not offer a single, strong solution for BIM. In fact, it offers two weaker platforms: Revit, for simpler, smallish projects; and AutoCAD, with a future in building that even Autodesk executives question.

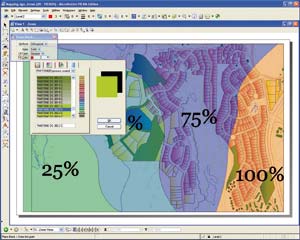

In geospatial, we offer solutions with CAD/GIS integration as well as interoperability. ESRI is a great, isolated GIS product, especially for non-infrastructure projects. But, for infrastructure projects, geospatial users prefer to plan in the context of engineering, and engineers prefer to design and maintain in the context of GIS.

Here, we’ve just announced our unique Google Earth connection. It’s amazing! We believe that it will become the most popular way to view and navigate CAD and GIS data together.

At the high end, we’re unique in offering CAD/GIS interoperability – where the two systems communicate in real time. By eliminating never-ending CAD to GIS translations, governments, utilities, and communication companies are slashing data loss and streamlining workflows.

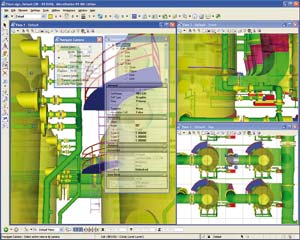

In plant, we offer comprehensive solutions for the distributed enterprise, whereas Intergraph is offering a 1980s solution to a 2006 problem. Plant owner-operators need a lifecycle solution that thrives in the distributed enterprise, whereas Intergraph’s solution is a frozen-in-time centralized system that struggles to scale to today’s requirements.

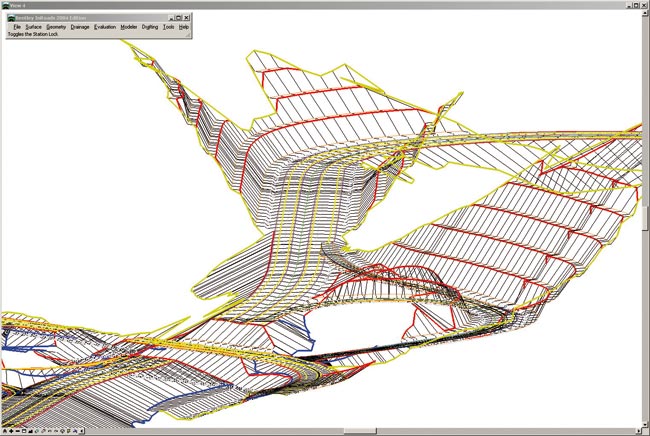

In civil, we have lifecycle solutions for road, rail, site, and water infrastructure. In fact, water and road are two of our strongest segments. We have a particularly strong maintenance solution for rail, and site design is an emerging market for us, especially given the opportunity presented by Autodesk’s transition from LDD to Civil3D.

![]() AEC CAD appears to be mature market with few new users. Where do you see Bentley’s growth coming from? Or are there new customers?

AEC CAD appears to be mature market with few new users. Where do you see Bentley’s growth coming from? Or are there new customers?

TF: Again, our market is software for infrastructure. Worldwide, construction of infrastructure is a $4trillion business. By comparison, the GDP of the world is about $40trillion. So I’m not sure I agree that software for infrastructure is a “mature market with few new users.” Quite the opposite, there’s much to improve in this $4trillion investment, and we are eager to help with software.

Tens of thousands don’t even have professional CAD software, particularly in the developing economies of China and India. Current CAD users want more vertical applications in order to be more productive and produce better work. Collaboration software is becoming more attractive – to the point of becoming a requirement – in a world of distributed enterprises.

Also, we see an expanding market for O&M (operation and maintenance) software, especially for railways, plants, and roads.

Besides, Bentley is very competitive and always on the lookout for adding more value. So we’ve set our sights on gaining market share in all of our verticals.

![]() Has BIM been a measurable success, a slow burn or a non-event?

Has BIM been a measurable success, a slow burn or a non-event?

TF: A definite, measurable success, and gaining momentum. We have many users applying BIM, and many even setting it as their standard of practice. Nearly every architecture and A/E firm now aspires to BIM and wants a path to BIM in their software solution. This is not just for architects, but for engineers (structural and building services as well), and it’s even quite relevant for construction conglomerates.

Most importantly, even owner-operators, who write the cheques and are the ultimate decision makers, are increasingly demanding BIM. Good examples of this in the US are the General Services Administration – the largest owner-operator in the US – and General Motors.

BIM unites everyone in the supply chain, thus improving it. BIM is now virtually always a component of any discussion with architects and engineers and contractors, and it is always about “how”, never about “if”.

![]() I’m impressed with the growing following for Bentley’s SmartGeometry technology which is still in beta. How does SmartGeometry fit into the Bentley’s architectural suite?

I’m impressed with the growing following for Bentley’s SmartGeometry technology which is still in beta. How does SmartGeometry fit into the Bentley’s architectural suite?

TF: Yes, the technology is inspiring and one that allows people to do something they could not do before. But note that Bentley’s technology is named GenerativeComponents (www.bentley.com/gc); “SmartGeometry Group” is a non-profit organisation of users/advocates/researchers (www.smartgeometry.org). GenerativeComponents is the high-level conceptual tool that allows designers to experiment with building shapes and, by design, stay within the design requirements.

To answer your question, GenerativeComponents is 100% integrated with Bentley products. It can drive geometry and coordinate with any of Bentley’s BIM portfolio, including Bentley Architecture, Bentley Structural, Bentley Building Mechanical Systems, and Bentley Building Electrical Systems. It’s part of the beauty of a single, strong BIM platform – this world-class conceptual tool immediately raises all these boats.

![]() Bentley’s route to market is a mix of direct and dealer (VAR). Moving forward, what’s the channel strategy?

Bentley’s route to market is a mix of direct and dealer (VAR). Moving forward, what’s the channel strategy?

TF: To major accounts, we sell directly. To small to medium accounts, we use eSales often assisted by channel partner experts.

Increasingly, we’re finding that eSales with product specialists is the best and most leveraged way for Bentley and the buyer. As our product line and target geographies expand, it’s the most efficient way to understand needs and communicate value to all corners of the world. It also happens to be our fastest-growing distribution method.

![]() Last year Bentley ran an aggressive ‘you deserve better’ campaign against Autodesk’s upgrade policy. How successful was it? Will you be doing the same this year? Isn’t MicroStation more expensive to buy and own?

Last year Bentley ran an aggressive ‘you deserve better’ campaign against Autodesk’s upgrade policy. How successful was it? Will you be doing the same this year? Isn’t MicroStation more expensive to buy and own?

TF: It was the most successful campaign we’ve ever run to upgrade Autodesk users to Bentley products. We found that CAD users need their products to natively support the three most popular file formats, DWG, DGN, and PDF. And they need historical, non-retiring support of these formats – not forced retirement that carries expensive and unfortunate consequences.

They also appreciate the superior price/performance of PowerDraft, the vertical Power products, MicroStation, and MicroStation applications. In hybrid accounts, we also see a move to consolidate DWG/DGN support using MicroStation – a move the significantly lowers their cost of administration.

In China, our PowerDraft Web site is the most popular offer we ever made. You’ll soon hear about this year’s “you deserve better” programs.

![]() Bentley doesn’t appear to have a traditional view to marketing brand and technology. What’s the marketing strategy?

Bentley doesn’t appear to have a traditional view to marketing brand and technology. What’s the marketing strategy?

TF:I’m not sure what a “traditional” view of marketing is. Regardless, we have a focused and strong marketing strategy.

First, we are uniquely and strongly positioned as a company: Bentley provides software for the world’s infrastructure. That is very focused, easy to understand, helps to drive our colleagues every day, helps to draw partners, and it’s clear to our users and prospects that we want to improve their business and our world. Again, we’re the largest software vendor dedicated to this market.

Second, we provide important networking opportunities for our users. In their fast-changing world, they want to learn best practices from each other in order to stay their most productive. Here, the BE Conference is wildly popular, with 99% satisfaction rates among attendees. The BE Awards identify and promote the most amazing projects of our users. BE Magazine, as well, has the largest circulation of any digital magazine in our space.

Third, we sponsor a thought leadership series for executives. Increasingly, technology is becoming a strategic issue in our user organisations – it is a top reason why they thrive. Executives want to stay abreast of the latest trends and developments of not just our technologies, but also related technologies. They typically think forward two to three years. And they typically enjoy discussing it with a small group of like-minded executives, mostly within their industry. This series give them that opportunity.

Finally, in identifying and interesting new users, we like eMarketing. Using bentley.com, email, eSeminars, and more as a marketing machine offers us much higher ROI than traditional means -about 100 times higher. And it’s better and more efficient for the prospect. We can communicate directly with them and understand their needs as individuals – anywhere around the world! And they can quickly get the detailed information and the sales expert they need to make their decisions.

We’re excited that our bentley.com traffic is up over 200 percent year-over-year. And recall that eSales, the partner of eMarketing, is our fastest growing channel.

![]() The BE Conference appears to be the main event on the Bentley Calendar. This year there’s a European mirror event in Prague. What are the main ingredients of the BE conference? Why Europe now?

The BE Conference appears to be the main event on the Bentley Calendar. This year there’s a European mirror event in Prague. What are the main ingredients of the BE conference? Why Europe now?

TF:The BE Conference comprises once-a-year learning opportunities for Bentley users and their managers who want to sharpen their skills and expand their knowledge. It has over 300 keynote, training, new-technology, and best-practice sessions. BE Conference 2006 happens in Charlotte, the home of NASCAR, in late May.

For our European users this year, we are essentially recreating BE Conference 2006 in Prague in early June – with one exception – the BE Awards of Excellence judging and ceremony takes place only in the US.

Why in Europe now? It’s a question of demand; Our users are asking for it. For many of them, it’s far easier to attend there.

![]() What are the challenges facing Bentley in the next three years?

What are the challenges facing Bentley in the next three years?

TF: Maybe I should say that my immediate challenge is completing this tough interview! Bentley’s biggest challenge is to continue to increase our value-add to the infrastructure market. Here, we want to continue to define the state-of-the-art in technology – our heritage. Here, we want to continue to expand our portfolio of solutions through strategic and timely acquisitions. And, here we want to continue to lead the market in interoperability.

Another challenge is to continue to expand internationally. The whole world needs infrastructure and we want to fully help all countries increase their infrastructure performance. You may already know that we have moved two senior executives to Asia to better serve those markets. There and throughout the world, we are improving the reach and efficiency of our sales, marketing, and service models. And, before I end, I want to mention that we’re off and running with global services – with over 500 professionals, we have perhaps the largest service organisation in infrastructure software in the world.

And, ending with marketing, we need to continue to clarify our advantages over Autodesk, ESRI, and Intergraph. That’s a challenge that we welcome because, for the infrastructure market and organisations that we serve, the advantages that we offer are clear and compelling.