Geological and geophysical modelling and analysis specialist will help Bentley take infrastructure digital twins deeper underground, writes Greg Corke and Martyn Day

Bentley Systems is to acquire Seequent, a specialist in geological and geophysical modelling and analysis software, in a complicated deal worth $1.05 billion, made up of cash and shares.

The acquisition will help expand Bentley’s infrastructure digital twin offering, for better planning, delivery, operation, and maintenance of infrastructure assets, as well as mines.

The company’s current offerings enable digital twins to incorporate what’s constructed “near surface,” including foundations, drainage facilities, buried utilities, tunnels, and subsea structures.

With this deal and Autodesk’s recent acquisition of water specialist firm Innovyze, the gold rush for the digital twin market seems to be, perhaps fittingly, happening all underground. Read our analysis

The addition of Seequent will now make it possible for infrastructure digital twins to reach “full subsurface depths”, augmenting environmental resilience against flood, seismic, climate, and water security threats.

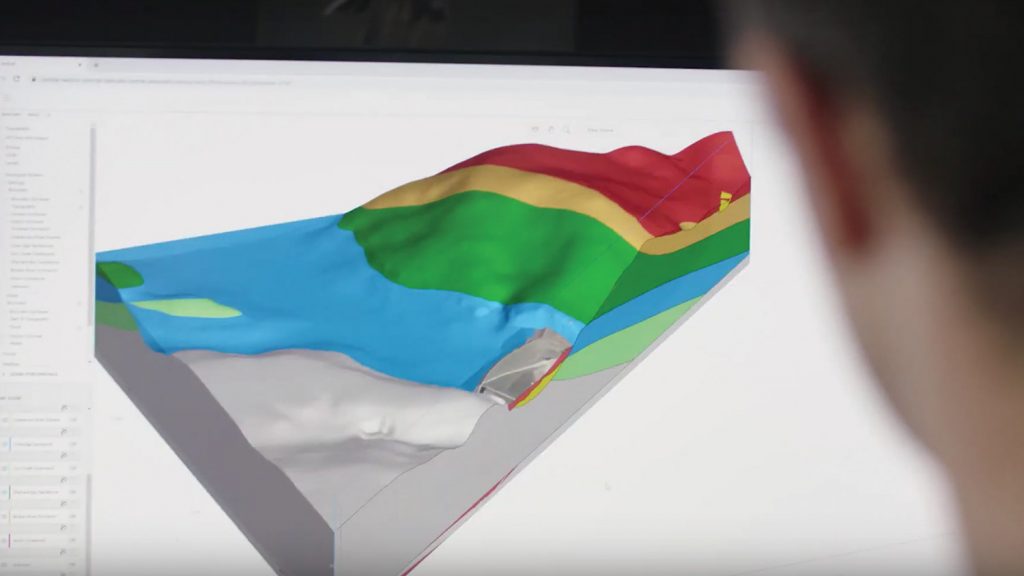

Seequent’s products include Geosoft for 3D earth modelling and geoscience data management, GeoStudio for geotechnical slope stability and de-formation modelling, and Leapfrog for 3D geological modelling and visualisation.

Leapfrog appears to have particular relevance to infrastructure projects. The software is designed to replace traditional 2D subsurface modelling and simulation processes. According to Bentley, the usage of the software, often in conjunction with Bentley’s software offerings, has been growing consistently in civil infrastructure sectors.

Bentley has stated that its complementary geotechnical engineering software portfolio, including Plaxis, gINT, and OpenGround, will be integrated in due course to support ‘open digital workflows’ from borehole and drillhole data to geological models and geotechnical analysis applications.

Headquartered in Christchurch, New Zealand, Seequent has more than 430 staff in 16 office locations, serving geologists, hydrogeologists, geophysicists, geotechnical engineers, and civil engineers in over 100 countries, and several leading mining companies.

AEC Magazine’s thoughts on the Bentley Seequent acquisition

The AEC industry has gone acquisition crazy this year and there seems to be two core drivers: adding revenue and fleshing out digital twin strategies.

Bentley Systems has always been a dominant infrastructure player – roads, rail, power and water – and in recent years has bet the farm on digital twins being the next big thing.

The kind of clients that Bentley tends to serve have probably most to gain from digital twins, having either expensive country-wide or global assets that need maintaining and monitoring.

The acquisition of Seequent builds on its underground modelling capabilities and strengthens Bentley’s position in mining and emerging countries. With Autodesk’s recent acquisition of water specialist firm Innovyze, the gold rush for the digital twin market seems to be, perhaps fittingly, happening all underground.

The huge challenge for Bentley will be how to integrate Seequent’s technology into its already diverse stack. Bentley’s open approach to digital twins should serve it well here and some Seequent tools already link with Bentley’s OpenGround platform for geotechnical data management, but the integration of analysis technologies is no easy task.

Bentley is still figuring out how to properly integrate its structural analysis applications with the geotechnical analysis software it acquired from Plaxis in 2018. An integrated analysis application that can handle both linear structures and non-linear soils at the same time, was a compelling vision. Now it has a whole new suite of analysis tools to consider.

From a financial perspective, as Bentley is now a listed company it has given up its option to choose to not report its detailed financial performance (although historically the company CEO, Greg Bentley, frequently did). Only a tiny proportion of stock is currently available, and we expect the company to go back to the market and raise some rather large sums over the next few years, funding more acquisitions of this size, as well as strategic investments in start-ups and additional R&D.

Buying established developers, like Seequent with stable incomes and profitability makes sense, as this will also help drive Bentley grow and return shareholder value.

For now the industry is underground, and as the saying goes, ‘where there’s muck there’s brass’.