As Autodesk accelerates towards a subscription-only model for its CAD tools and services, Martyn Day analyses what it all means

Autodesk, the volume leader in the CAD market, is now well on its way to transforming its business model from selling boxes of software to supplying design tools to customers solely on subscription.

Autodesk has decided to accelerate its phased plan to stop selling perpetual licenses of software. It had announced that as of January 31, 2016, it would no longer be possible to buy perpetual licenses of individual products (Revit, AutoCAD, Inventor etc.). Now, from July 2016, Autodesk will no longer sell perpetual licenses of its bundled application ‘Suites’ (Autodesk Design Suite, AutoCAD Design Suite, Building Design Suite, etc.). New customers will have to sign up for a time-based subscription contact for the applications or suites they require.

This accelerated move will mean that by mid-2016, Autodesk will have an almost entirely subscription-based business model, following slowly in the footsteps of Adobe, the industry’s poster child for subscription transition, which went harder and faster than any other company and upset many customers in the process.

The reason given for the acceleration by Jeff Wright, vice-president, strategy and marketing at Autodesk, was that the company realised that having a foot in both camps — perpetual licence sales and subscription only — was a lot harder to transition than originally envisaged. There was a recognition that the company needs to be “in one camp”.

To smooth this transition, Autodesk will offer a range of simplified subscription plans for individuals, teams and enterprises, Mr Wright said. Customers will be able to purchase individual or shared subscriptions with the option of single user licensing or shared network licensing. Those customers that purchase or purchased a perpetual license of Autodesk Design & Creation Suites to July 31, 2016, will continue to own those licenses, and customers on existing maintenance contracts will continue to receive updates and new releases for as long as the maintenance is kept.

Why subscription?

In the 1980s and 1990s Autodesk used to release updates to its only product, AutoCAD, every two to three years and went through extended periods of marketing and selling upgrades to the next release. Customers tended to upgrade their software every three to five years and there was not a maintenance option.

For many businesses this was painful. A lot of energy and money was spent to get the installed base to move along with new developments. Now that Autodesk has many products in its portfolio, covering multiple vertical markets, and is moving from big yearly releases to streamed updates, serving a subscription-base. This represents a major transformation and has potential business benefits to Autodesk:

Predictable recurring revenue vs burst is good for the markets, smoothing out quarter-to-quarter financial results.

By going increasingly direct there is additional margin for Autodesk.

Subscription management software makes piracy more difficult.

Less monolithic development of apps, more dynamic updates.

Bigger potential to offer services for higher subscription levels.

Lowers the barrier to entry for new customers.

Potentially means less income now but greater income per customer over time.

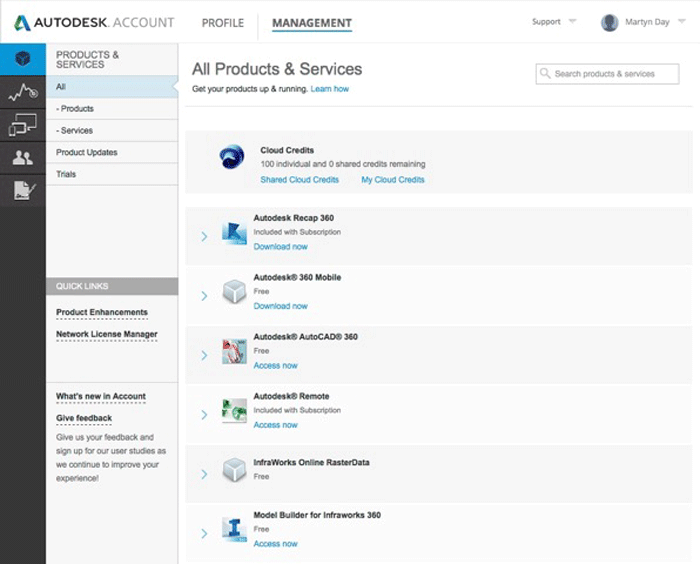

Subscription’s bedfellow of choice is ‘the cloud’ and Autodesk is also in the midst of architecting a potential formidable backbone with its ‘360’ product portfolio, which connects and merges desktop, mobile and cloud-services. Autodesk Subscription plans include various levels of cloud-based storage and extended features, such as fast rendering or analysis. Autodesk has gone from offering a DOS-based 2D drafting tool to building 3D design ecosystems, spanning multiple platforms.

Pros and cons

Subscription’s most noticeable benefit is the lack of a ‘joiner’s fee’. To buy a perpetually owned seat of AutoCAD costs several thousand pounds and is something that needs to be budgeted for. To get a seat of AutoCAD on subscription costs £185 a month, no up front fee. Seats can be increased or dropped quickly, so should the market go into recession, overheads can be cut. Subscribers will also have access to the latest release with a global-use license and there are cloud benefits too.

For accountants, subscription payments are operational expenditure, as opposed to buying the software which is capital expenditure with a depreciating asset over years. Subscription payments are therefore tax deductible within the same financial year. Although here, it is arguable if Autodesk products are a depreciating asset, given the efforts the company made historically to stop users reselling their perpetual licenses.

Autodesk also highlights that subscription comes with e-learning and telephone ‘technical support’, but with exceptionally mature and complex products this is remote. It certainly will not be like having local help from a reseller or hands-on training. That kind of support will cost, probably a lot more than the product subscription.

While there are undoubted benefits, some customers see a move to subscription as a loss of freedom. In the past the customer could evaluate upgrades to see if they offered value to their business and would pay to upgrade or opt to miss out. Autodesk’s move to predictable yearly releases increased the frequency of this evaluation but also the upgrade pricing was concocted to penalise those that fell behind, making subscription of perpetual seats the lowest cost of ownership.

Then there were the dreaded DWG format changes and the ‘obits’ — when a version of a product over three releases old (so, three years’ old) were retired and customers were given the option to upgrade or lose that capability. Now with the subscription-only model less than a year away, it is very much a take it or leave it, term-based access and for those not pushing the boundaries or using the cloud, mobile or collaboration, the added benefits seem, at the moment, completely hypothetical.

As Autodesk moved into subscription, it had noticeable teething problems getting the ‘portion size’ for annual fee. Suites on subscription compounded the issue further. Levels of user contentment with updates varies within each vertical market, but there have been many negative comments on the pace of development of Revit in return for the subscription monies paid. For example, firms may have the Building Design Suite, but most designers use Revit for over 90% of the time. The enhancements, however, are spread across the multiple products in the Suite.

The situation is much more clear cut when looking at new and quickly expanding products like Autodesk Fusion 360, a 3D CAD/CAM tool designed for multiple OS, mobile and cloud from the get-go. It has only ever been sold as a subscription product and is only $25 a month. Its aim is to torpedo the current Windows/desktop-based modelling tools and is priced to penetrate as a companion seat that eventually usurps the likes of SolidWorks, a popular product design and engineering-focused CAD tool.

Customers of 3D mechanical design toolAutodesk Inventor get Fusion as part of the subscription and so Autodesk is playing the hunter, as opposed to the farmer, with its own mature desktop products, which have yet to become truly cloud applications.

Channel model

Autodesk’s move to subscription opens up questions about how, in the future, the company envisages its relationship with its Value Added Distributors (VADs) and Value Added Resellers (VARs). The distribution layer is clearly being replaced with web fulfillment and for a long time, Autodesk has been weaning VARs off relying on revenue from box and upgrade sales. Changes to Autodesk’s engagement with its existing channel has always been a delicate issue, due to its symbiotic nature.

So far, the proportion of maintenance/ subscription revenue paid to VARs has helped resellers survive through some very tough economic times. But with Autodesk selling increasingly direct in enterprise accounts and now moving new business to subscription-only accounts, how will the VARs be rewarded?

Many have moved to offering training and consultancy, but that brings its own challenges. Autodesk’s products are a lot more complex than hours of e-learning will ever be able to convey.

Despite the low monthly price, products like Fusion include high-end CAM capabilities, which requires a lot of expertise and training. The cost of training and consultancy for this would be prohibitive.

I suspect that over time many small resellers will cease to exist and only those with large installed bases will get enough out of customer services to survive.

Conclusion

The move to the cloud and to subscription is commonly seen as extinction level event. Those who had a big presence on the Windows desktop are not necessarily going to be the winners on future mixed devices and mixed operating systems. Autodesk is ahead of its competitors in this regard and it is now compressing its timescales further.

Autodesk Fusion 360 serves as an indication of the cloud-architecture expected for all products in the vertical markets. Running over the Internet, on a cloud server, applications will be almost impossible to pirate.

With distribution and VAR margin removed or reduced considerably, Autodesk would also keep a bigger share of the subscription payments. It makes good business sense.

The key issue will be to ensure customers believe the subs fees provide value for money, instead of feeling they are merely renting the software. Autodesk needs to ensure customers use a range of the new tools and services to warrant the cost.

From up in the cloud, Autodesk will still have to nurture customer and partner relationships, as well as improve development and velocity of its core platform products.

If you enjoyed this article, subscribe to AEC Magazine for FREE