AEC hasn’t covered Bentley Systems’ civil engineering products for a while, so Martyn Day caught up with Gregg Herrin, Global Marketing Director, Civil, to discuss the company’s ‘somewhat overcrowded’ civils product portfolio.

Gregg Herrin was formerly with Haestad Methods, the software developer for the water resources industry. He stayed with the company following Bentley’s purchase of Haestad Methods in 2004 and now heads up the marketing of Bentley’s Civil Engineering and Design portfolio. With Autodesk stepping up the pressure to build on its installed base in the Civils market, we talked to Herrin about Bentley’s offerings, which on first looks, appear very confusing.

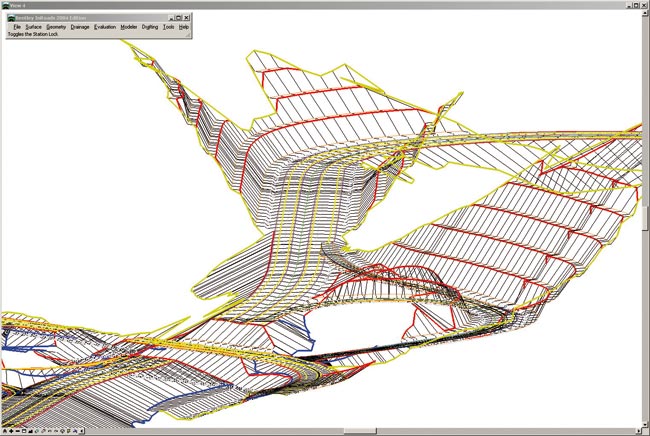

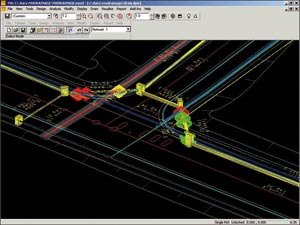

Martyn Day: How do Bentley’s Civil products fit together? Looking at the Bentley website it appears to be a bit of a mess. There’s Geopak which was bought off a MicroStation developer, InRoads which Bentley purchased from Intergraph, and now the MX Products, acquired with Infrasoft. This is not to mention Haestad Methods. On the Bentley website, Bentley has over 40 products ranging from road design and surveying to sewer and bridge design. For a lot of areas Bentley has multiple solutions.

Gregg Herrin: I agree! Our portfolio poses a lot of challenges but also opportunities in the Civil design market. While at face value it appears we have a number of very similar products with similar functionality, the clarity as to what fits where can only be seen at a regional level. Due to historical adoption, some geographies are more prone to one of our solutions than others. For instance, there are no Geopak seats in the UK; it’s clearly dominated by MX.

In the US, it’s a bit more tricky as InRoads and Geopak have about a 50/50 market split. So here, most States have a dominant system, or it depends who you are working with. If you work with a Geopak user, then that’s the system you should get. In many ways it’s similar to the way you go about using different email products, like Lotus Notes, and how you access that through the menu system.

While Bentley has bought a lot of technology, there was overlap as the products were mainly developed before Bentley acquired them. Clearly it would be a lot of work to program or update the same functionality three times. So looking forward we developed an evolutionary strategy, so not matter which product you chose behind the front-end, they shared the same, common framework, offering the identical underlying capabilities. So it doesn’t matter what format it’s stored in.

Our strategy is to move to one master product. We are not in a hurry to do that, we are working our way through the underlying technology, so the new code is written once, tested and available everywhere. Our customers have invested a lot of money to train staff and it’s not something we want to just throw away. We are aiming to migrate towards ‘commonality’ but in the process we are not going to shove users off a cliff. In the meantime, all three products are being developed, sharing as much commonality as possible. So all three products are advancing.

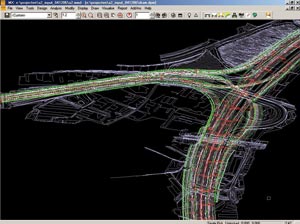

As things stand, 48 out of the 50 US States’ Department of Transports are Bentley customers, with six out of Canada’s twelve provinces also standardising on one of Bentley’s Civil products. Autodesk’s purchase of Caice only gave them access to California DOT as a customer but their usage is split, as they use Bentley Civils products too.

Unfortunately, on the issue of interoperability between the products, this is not possible; taking MX data into InRoads is not feasible. In time it may be possible to move some data between the systems using an XML schema but it will be some time before this could be available.

Conclusion

Autodesk is taking the approach of standardising on AutoCAD as the platform and building functionality through third party developers, or acquiring the technology if there’s a product fit. If you read the Autodesk University report on page 12, you can read how Autodesk intends to release niche variants of AutoCAD Civil, for rail, highways, tunnels etc.

Bentley pretty much went out and purchased the market by buying the key global players and then initiated a long-play strategy of converging the functionality behind the scenes, while keeping the interfaces of choice with its customers and not upsetting the applecart.

Autodesk’s product has a long way to go and Bentley has the lion’s share of Civil developers in its camp. The one trump card AutoCAD has is the endemic nature of AutoCAD which is everywhere. AutoCAD users may prefer the Autodesk solution when it matures, as it uses a standard AutoCAD interface. But all that data in DGN will be hard to translate over intelligently, even if the next AutoCAD has a DGN in and out capability.