Martyn Day explores the rapid evolution in the way AEC software companies charge for licences and shepherd their users to boost revenue

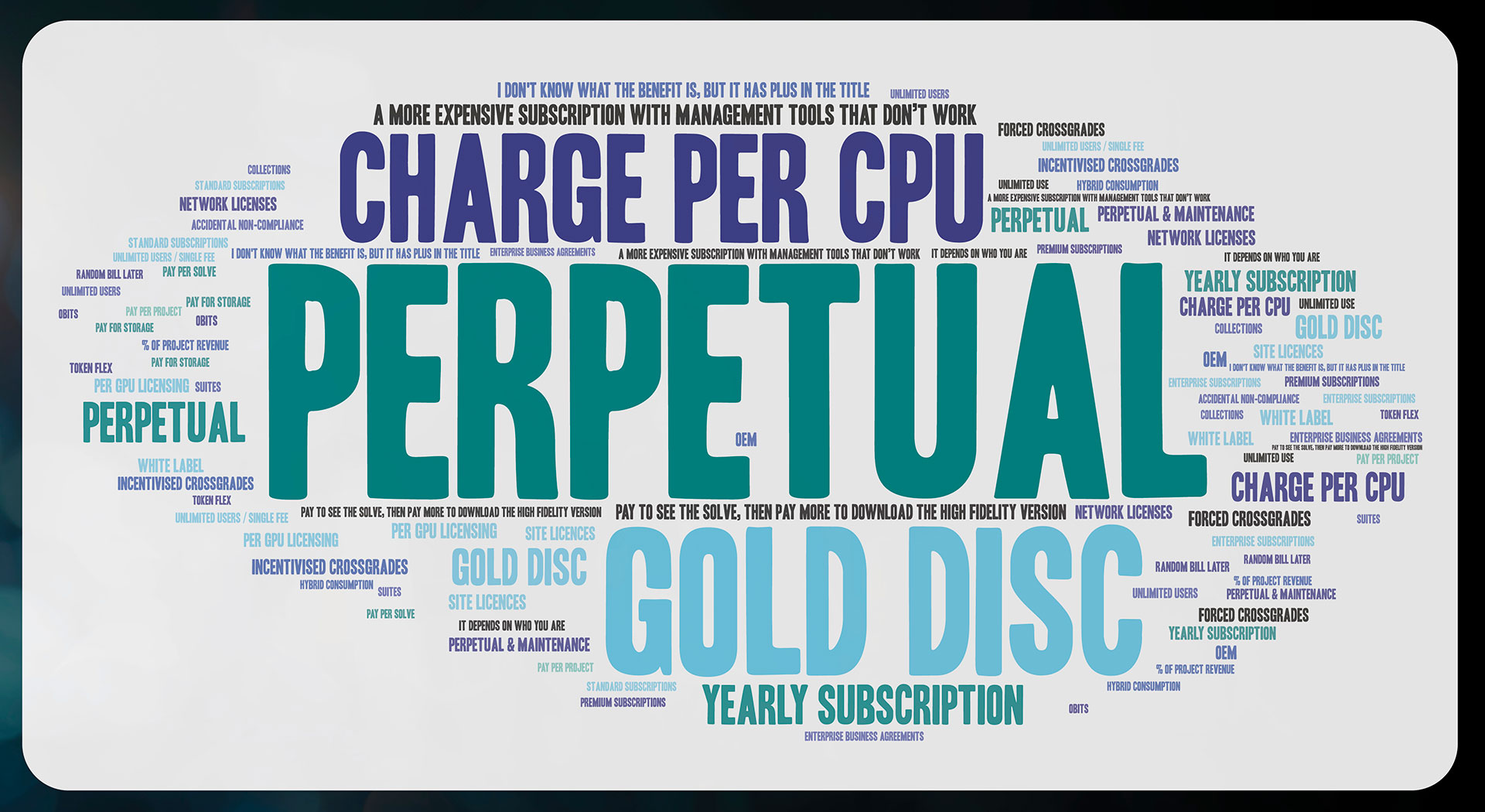

At AEC Magazine, we’ve lost track of the countless ways software companies have altered their pricing and licensing models over the nearly 20 years we’ve covered BIM.

What’s evident is that this pace of change is accelerating as developers continue to refine their business models, shifting from traditional per-unit pricing to a ‘service-based’ model.

It now appears that if one major player successfully implements a change— measured by increased revenue or seats sold— the rest of the market will sheepishly follow.

This hasn’t helped customers. Design IT directors manage tech stacks which typically comprise multiple products, from multiple vendors, across multiple sites and possibly multiple geos.

Licence model changes are typically made to increase the revenue of software firms. This increases the cost of ownership and can also increase the time it takes to manage those licences. In short, it drains hard pressed budgets. Operating the same product, but on multiple different licences, increases the chance of being fined under licence compliance audits.

When a firm consistently adds new seats each year, the likelihood of differences in End User Licence Agreements (EULAs) increases, especially as software companies operate multi-year licensing but are rapidly evolving their licence models.

One might expect vendors are offering diverse licensing options to accommodate the wide variety of business needs, but subscription models in our industry remain surprisingly inflexible.

Business evolution

The design technology market is what one would call a mature software industry. In the 1980s, firms like Autodesk and VersaCAD pushed architects to trade in their drawing boards for desktop CAD. Today, it’s safe to say that professional design firms now rely on CAD systems far more than paper.

Over time, the opportunity for new sales has diminished, leading software firms to focus on getting existing customers to purchase more. In business parlance this means that the CAD market is highly saturated and highly penetrated. This saturation often results in diversification, with vendors developing additional products to expand their customer base. Their sales departments become very concerned about ‘attachment rates’.

Companies like Bentley Systems and Autodesk, once known for a single product, have now expanded to offer hundreds of solutions across various vertical markets.

Occasionally, a new generation of technology emerges, allowing companies to replace outdated systems. These shifts are rare, occurring roughly every 10 to 15 years.

Historically, such transitions have aligned with major operating system changes, like the shift from Unix to DOS or DOS to Windows. However, during these periods of transformation, it’s never certain that the dominant applications or leading software firms will retain their top position post-transition.

Find this article plus many more in the Sept / Oct 2024 Edition of AEC Magazine

👉 Subscribe FREE here 👈

Perpetual to subs

For about 30 years, software firms sold perpetual licences, granting users never ending access to a particular version of the design software. Depending on the development cycle, every few years the vendor would go back to try and upsell the customer to the next release by hopefully providing features deemed worthy of the upgrade price. This was always a hard slog for software firms and cost a lot in marketing and sales. Maintenance fees became common to naturally progress the sales cycle. Still, many customers would not upgrade every release, typically upgrading every three years. It was possible to be an Autodesk customer that hadn’t spent any money with Autodesk for years.

As software vendors diversified and created numerous applications for design management and creation, the opportunity for bundling emerged. Companies like Corel, with CorelDRAW, pioneered the idea—appealing to users’ desire for perceived value by offering multiple applications at a discounted rate. Autodesk followed suit in 2012, capitalising on vertical markets by bundling popular products like AutoCAD, Revit, and Navisworks.

In 2013 Adobe then championed subscription and moved its Creative Suite product delivery to the cloud. Subscription replaced perpetual licences and the cost of ownership per licence went up.

Pretty much all software firms learnt from Adobe’s experience. In the CAD space Autodesk was first to manage the migration.

In 2016, Autodesk introduced subscription and transferred Suites into Collections as an alternative to perpetual licences. By 2020 Autodesk wanted to stop perpetual sales and convert customers and gave customers a number of years to migrate. At the same time, it culled network licences and moved to named user sign on, mandating a seat per user.

While this was shocking, Autodesk did offer a killer deal, offering two subscription licences for every single perpetual licence handed in, for a period of 8 years. Depending on when firms moved, some will need to start paying for these extra licences from 2028 onwards (in four years’ time). It’s likely that the design IT manager who signed up for the deal, is no longer at the same company.

The last five years

Today, we have a world of connected cloud and mobile apps combined with named user subscriptions, giving vendors direct access to customer usage and contact details, which were previously obscured by reseller channels. This direct link also opened-up new possibilities for increasingly direct sales models, services and usage billing. Procore, for example, has championed ‘per project’ fees.

As software firms have further refined their cloud and subscription packages, many historical discounts have been removed.

In response, some customers have adjusted their strategies to fit their budgets, downsizing certain products and replacing applications from developers perceived to be price gouging. Of course, this approach only works when viable alternatives are available.

We’ve come across several instances where software vendors have raised prices by 100-300%, making it difficult for existing customers to avoid steep hikes or forced product migrations. Vendors often pressure clients by threatening to shut down hosted servers for ‘legacy’ software, forcing them to accept new terms or face repurchasing all software at full market price.

Design IT directors already juggle billable hours alongside IT management tasks such as upgrades, cross-grades, and user onboarding and offboarding. When vendors go rogue, the extra time needed for evaluation, transition, and migration to a replacement product becomes an unwelcome burden.

Cloud integration

The focus of several vendors has shifted to integrating and delivering services via SaaS. Procore, Autodesk, Hexagon, Trimble have all expanded and embellished the cloud component of their business. New features are increasingly being added, as opposed to delivered in the design software.

We’re moving toward a world where pure-play desktop applications are becoming rare, with users relying on vendors for hosting, applications, collaboration, and business functions. This is already producing some anxiety in customers who fear being trapped in proprietary cloud with limited API access. Perhaps sensing this distrust, most vendors are now talking about how ‘open’ they are, should that be file access, programming, or Application Programming Interface (API).

Artificial Intelligence

Although current AEC software features limited artificial intelligence, AI is poised to make a significant impact when applied at scale, potentially transforming the industry with advanced expert systems.

For the next year or so we will probably see small features and tasks benefiting from AI with more in-depth applications after that. AI-driven expert systems promise significant productivity benefits, posing a challenge to existing software business models. In 10 years’ time, one wonders how many seats of full BIM will be required to manually hand craft detailed schematic design models and generate documentation. With less software and more service, business models will change.

Conclusion

The need of software firms to maintain growth in a highly saturated and penetrated market has led to rapid ‘innovation’ in business models which outstrips the budgets and perceived value provided to customers. Design IT directors are having to juggle budgets to provide teams with the tools they need.

After years of feedback and complaints, it was a logical choice at this year’s NXT DEV conference to host a panel discussion on how software pricing, licensing, and business models affect firms (see box out below).

The frustration levels are high and with price negotiation seemingly being automated out of the process, there seems to be a valid discussion to be had over value. If a software tool is biased towards conceptual design, it might be heavily used for three months out of a three year project, but it’s priced as if it’s used eight hours per day, every week of every year.

At AEC Magazine, we’re already contemplating the future beyond individual software subscriptions. We’re beginning to see firms experiment with project value-based fees. With the advent of AI, auto-drawings, automation, and expert systems, the potential to significantly reduce the amount of software, labour, and time needed could drive productivity beyond anything we have seen before.

As the industry remains focused on recurring seat licence volumes, the future may demand a hybrid business model combining software access with transactional services and monitored CPU/GPU usage. This shift could necessitate software companies gaining deeper insights into project or customer finances—a prospect that is unlikely to go down too well.

The voice of the customer: NXT DEV panel discussion

After hearing numerous complaints from design IT directors about the constantly changing business models of software companies, we decided to dedicate a panel session to this topic at our recent NXT DEV conference. The goal was to offer critical feedback to current software and service providers in the AEC market, while also providing key insights to start-ups developing their pricing and licensing strategies.

The panel session was moderated by Richard Harpham, formerly of Revit, then Autodesk, and now co-founder of Skema. The panel included Iain Godwin, ICT Consultant to many AEC practices and former IT director / senior partner at Foster + Partners, Jens Majdal Kaarsholm, director of design technology at BIG (Bjarke Ingels Group), Alain Waha, CTO Buro Happold and Andy Watts, head of design technology at Grimshaw.

Many presentations at NXT DEV highlighted a growing concern among AEC firms about their data being locked in the cloud servers of software vendors, compounded by fears of restricted access through proprietary APIs. This pointed to a clear trust gap between vendors and their customers.

The panel members are responsible for their company’s design software estate, and explained how they are constantly evaluating value vs cost. They expressed how the felt ‘pushed into a corner as to how we will pay for technology’ by vendors.

Waha expressed concern about vendors engaging in ‘rent-seeking,’ aiming to extract money for shareholders without adding value. “They have identified us as sheep and we cannot defend against a large dominating organisation who will be rewarded and incentivised by capital at scale.” He then highlighted the irony that while these funds prioritise shareholder profits over technological advancements in the built environment, people, including himself, also benefit from strong pension returns.

Harpham played devil’s advocate. He said, “Vendors are not trying to do physical harm to the customers but there are business goals that make you change the way you work. You only have so many levers you can pull — you can ask a customer to pay more for what they have and right now that’s running about 5% per year. You can change the metrics and that ‘s what happened when we moved to subscription. You can re-package and that’s Suites/ Collections and then there’s licence compliance.”

Godwin, who was instrumental in the first Open Letter to Autodesk, stated that customers required trust in relationships with vendors. There were many aspects of the relationship with Autodesk that were schizophrenic. The Revit development team was trying to do its best, but the monetisation process and compliancy model undermines the trust and doesn’t help firms feel like they are getting value out of that relationship. And that was just the first five minutes!

We think this panel session is essential viewing. Tune in to hear what else was said.

NXTAEC.com

As a follow on to NXT BLD and NXT DEV 2024, our AEC technology conferences, we have launched NXTAEC.com, a dedicated video website where you can view all the talks from our recent events, including the incredibly honest Pricing, licensing and business models panel discussion.

NXTAEC.com is free. You just need to register. By implementing a registration system, we can offer capabilities like ‘watch later’, ratings, comments, playlists, share and dedicated video search with tags. Over time we plan to add more community features and facilitate ways to keep in touch with people you meet at NXT BLD and NXT DEV.

For now, we have uploaded content from the last three years of NXT BLD and the the last two years of NXT DEV. We will spend the Autumn backloading all the previous NXT BLD talks.

We want to keep the NXT BLD and NXT DEV vibe going throughout the year, so we also plan to use the site to produce and feature demonstrations from the really innovative AEC startups which we discover from our day job of researching the market for our bi-monthly AEC Magazine .

If you have not done so already, please register now.