For the second time in ten years, Autodesk is dealing with an activist investor problem. Will Starboard Value get its way, and if it does, what might be the knock-on effect for customers?

Among the trials and tribulations faced by executives running publicly listed companies, the difficulty of simultaneously satisfying the holy trinity of customers, board members and shareholders looms large. The rough and tumble of market competition may be fierce, but there’s plenty of potential for internal drama, too.

The insider currently waging war against Autodesk’s executive team is Starboard Value, an investment firm that has bought up some $500 million worth of Autodesk stock (about 1% of shares).

The company is now seeking to make changes to Autodesk’s management, operations and financial accounting strategy, in order to make it more profitable and thus drive up the share price. It has written a press release, letters to the board and fellow shareholders, and a comprehensive report explaining how this could be achieved.

Autodesk CEO Andrew Anagnost clearly has a fight on his hands, because Starboard Value has a good track record of getting what it wants.

Find this article plus many more in the Sept / Oct 2024 Edition of AEC Magazine

👉 Subscribe FREE here 👈

In April 2024, having delayed the filing of its annual report (Form 10K) with the Securities and Exchange Commission (SEC), Autodesk launched an internal investigation into accounting practices relating to multi-year enterprise subscription deals and how the company calculated free cash flow, a key metric used to evaluate financial strength and executive compensation.

In May 2024, Autodesk announced that it did not need to restate or adjust its audited and unaudited filings, but its chief financial officer was swapped out. The way this probe was handled is what seems to have instigated Starboard’s aggressive intervention and its claims that Autodesk executives had misrepresented financial results and deliberately kept shareholders in the dark. In Autodesk’s defence, one wonders if the company’s rapidly evolving subscription licensing model might have made recognising revenue from multiple payment contracts and timings, harder to track.

At the time of writing, Autodesk has managed to keep Starboard Value representatives off the company board via a court case. In June, the Delaware court ruled that Autodesk didn’t need to reopen the window to nominate directorial positions for a contested election at the July annual shareholder meeting.

Because Starboard Value missed this nomination window, it will have to wait another year for the next shareholder meeting to try and infiltrate the board, a timeline that industry watchers have said will not matter to the determined Starboard raiders. Meanwhile, they are metaphorically camped outside the Autodesk walls, occasionally lobbing in grenades, attempting to highlight changes it feels should be made to the company, both to other shareholders and to the market in general. Their efforts so far have generated additional litigation on some of the points it has raised. As we go to press, there’s a new potential class action suit from Shareholders Foundation Inc, seeking shareholders who bought Autodesk stock prior to June 2023 and were impacted by the share dip caused by the delay of filing the 10K. Autodesk is attracting the ambulance chasers.

Investor unrest

Readers who have been following Autodesk corporate politics closely and, in particular, the recent open letters sent by European and Australian AEC Autodesk customers might hope that this investor unrest and historic customer anger might be linked. However, they are not.

In fact, the situation is quite the opposite. The open letters from customers were borne out of frustration regarding a perceived lack of delivered value in product development, with price rises and compliance penalties for minor EULA infringements.

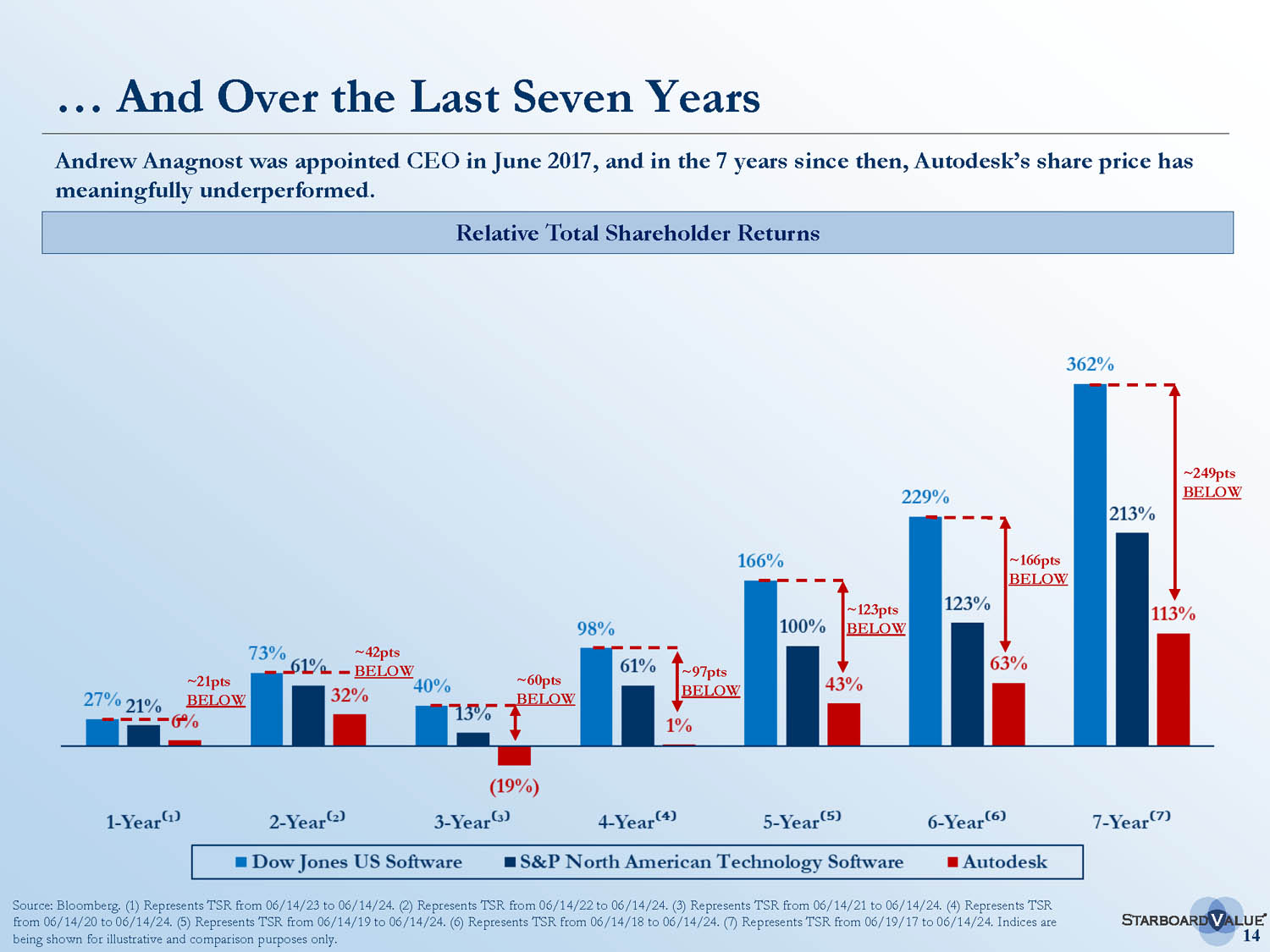

Starboard Value’s letters to the Autodesk board and subsequent legal action are based around claims that operating margins are weak, management compensation needs overhauling and that the company is guilty of mismanagement, shareholder misdirection and poor share price performance.

While customers may not be happy with Autodesk’s approach to business, under a Starboard Value-appointed CEO and weighted board, I can imagine things getting a lot worse

In the widely distributed presentation, Starboard rates Autodesk as an attractive business, because customers face a high cost of switching vendors. In Starboard Value’s words, customers have Autodesk products “entrenched in their workflows”, which gives the company favourable dynamics for “sustained pricing power”. This has led to a “highly recurring subscription revenue base” (as in, yes, you are trapped) and “growth potential for adjacencies, such as Construction Cloud”.

Starboard Value’s team are corporate raiders. They like the Autodesk business but believe it could be run more profitably with better cash flow, reduced discounts and by charging higher prices for a trapped global customer base. They don’t care what Autodesk does; what its customers do; what software advances it makes. Autodesk is a cash-generation engine, and Starboard Value wishes to profit from the delta in the share price increase, by implementing new management and making a series of business goal changes.

Along the way, the activist investor is making a series of demands. It wants to reevaluate CEO Anagnost. It wants to right-size the cost structure (by reducing overhead costs) and fix budgeting discipline (by spending less). It wants to overhaul the compensation granted to executives, switching away from yearly rewards to longer term targets. It wants to improve capital allocation (by using money to buy back shares to increase the price). Starboard Value claims Autodesk could achieve a 10% adjustment to operating margin, with benefits to cash flow.

Wall Street analyst Jay Vleeschhouwer, managing director of Griffin Securities and probably the global expert on performance CAD and design industry firms, has described Starboard’s presentation deck as: “A mix of factual statements (about share price performance and achievement of targets given at various Autodesk investor days); peer comparisons on various metrics; allegations (about board oversight and management performance); proposed financial targets; and, in our view, important omissions (including lack of competitive and structural context).”

Vleeschhouwer went on to say that while he believes Starboard Value has made some valid points, the overall complaint, in the main, is not “sufficiently convincing”.

(N.B Vleeschhouwer spoke at NXT DEV 2024 on the evolving business models in our industry. Watch his presentation here).

The changes that Starboard is seeking would likely increase street prices. There would be mass layoffs and cost reductions at Autodesk, in order to drive up operating margin. Everything would be done to increase cash flow and predictability, possibly impacting R&D budgets.

Recent changes to reseller contracts, rolling out over the world, swapping payment direct to Autodesk, will surely deliver that in spades, but that will not be complete for a year or so.

From Starboard Value‘s deck, the plight of customers being stuck in Autodesk workflows would leave them open to exploitation and could lead to more price gouging. While customers may not be happy with Autodesk’s approach to business, under a Starboard Value appointed CEO and weighted board, I can imagine things getting a lot worse.

Industry metrics

Boardroom battles are not a topic that AEC Magazine would usually cover, but big software firms in leading positions do inevitably attract the attention of this brand of activist investors who make money from doggedly pursuing stocks they think they can boost.

Autodesk is the market leader serving our readership, and CEOs can easily attract the wrong type of attention by missing industry metrics and seemingly underperforming expected stock price performance.

For CEOs, executives and board members, there are real consequences if these activist investors succeed, as well as for employees. I guess these are the rules of the financial jungle and, just as they did with the Autodesk CEO before (Carl Bass – see box below), these activist investors have proven they can spend years waiting for their moment.

I can’t see what else Anagnost could have done to increase money from customers any quicker. Autodesk has gone from $2 billion to over $6 billion under Anagnost in seven years

From a pure business perspective, having watched Anagnost iterate through business models, going from individual product sales to suite bundles, desktop to cloud, network licences to mandating named user, squeezing out distribution, squashing Value-Added Reseller margins, then taking all the VAR money direct, it is amazing that shareholders can be upset. However, it is true that this hasn’t necessarily been reflected in the share price post Covid.

As for turning around business models, companies are like oil tankers, it takes years. But I can’t see what else he could have done to increase money from customers any quicker. Autodesk has gone from $2 billion to over $6 billion under Anagnost in seven years. This results in pretty much a quarter-on-quarter chart with a steady 45-degree line of increase.

Anagnost began as the darling of the market, having successfully transitioned Autodesk to subscription payment with associated downstream boosts in revenue and a rocketing share price. The market judgement has changed once the installed based has been converted to subscription. I expect executives and members of the board hope that they have a year to ‘bed in’ the changes they have already implemented in the business model. Taking the whole payments for every deal will increase cash flow dramatically. It’s possible to lay off staff too. If operating margins improve and the share price ascends, Starboard Value wins with either outcome. On that basis, the question will be whether Starboard Value deems the operating margin is high enough to leave Autodesk alone.

From my point of view, which is a customer perspective, this is all a very lopsided value equation. Customers have little power. It’s one of the reasons the UK and Nordic Open Letters to Autodesk opted also to email the letter to Wall Street analysts, as they believed shareholders had more sway on the executive team than customers. With subscription, the right for customers to withhold revenue (not upgrade) for lack of valuable new development has vanished. You could complain to your account manager, but you still have to keep paying to use the stuff, as there are project deadlines to meet. Network licences have gone and licences for individual users are mandatory. Now historic discounts will also vanish. The only way to show displeasure is to migrate to another design tool provider, but as Starboard Value recognises, that is currently a tough call and means swimming against the industry tide.

Perhaps the best that can be achieved is for firms to actively address the issue by maintaining a more balanced mix of tools, while keeping alert for future lock-ins from pretty much all software developers.

In doing the research for this article, it’s clear to me that the key connecting link between customers, investors and Autodesk is via the company’s regular business model and licensing manipulations to optimise increasing revenue in such a way as to also meet its cash flow goals, a key metric which will reward the company’s value, share price and also the executives’ compensation.

As long as there is a stock market, shareholders and greed, investors will always come first. And if they feel they don’t, they will take direct action.

A recurring problem for Autodesk?

This is not the first time that Autodesk has had to deal with an activist investor. Between 2015 and 2017, Sachem Head and Eminence Capital acquired 11.5% of Autodesk’s stock and went to war with the company over operating margins and conservative long-range predictions.

They eventually managed to penetrate the company board to occupy three seats there. While on the board, they drove mass layoffs at the company to increase operating margin and ultimately got CEO Carl Bass to agree to step down – but on the proviso that, in turn, the activists left the board after the new CEO was elected.

Andrew Anagnost was chosen as the new CEO after a period of ‘co-CEOing’ alongside VP of product development, Amar Hanspal. This seemed logical, since Anagnost was the brains behind product bundling (suites) and driving the business shift to subscriptions to increase revenue from the base, following the Adobe model.

From what I could tell, he had been the star of Autodesk’s investor days, explaining the forthcoming change to the business model and giving investors that warm and fuzzy feeling associated with a promise to squeeze the lemon harder.

During Carl Bass’s tenure as CEO, he had overseen a revolution in software development within the company, starting products like mechanical CAD (MCAD) tool Fusion, in order to attempt to go after Solidworks and many other cloud and mobile apps. There had also been huge growth in acquisitions, hiring, investment in the maker revolution and expansion with workshop spaces like the Autodesk Technology Centre in San Francisco and Autodesk AEC space in Boston, complete with industrial robots.

The company was still profitable, and the share price was rising, but activist investors had their playbook of metrics and, at the time, Anagnost convinced them he was the man for the job