Will this latest change diminish the role of the CAD reseller?

Throughout its history, Autodesk’s business model has been constantly evolving. Someone joked on LinkedIn recently that ‘Autodesk’s business model is to get you to the next business model.’

For end users, this continual change has been seen in the form of product bundles, Suites, Collections, proprietary to subscription, tokens, removal of network licensing, mandatory named user licensing, etc. The rapid evolution has meant that many firms are operating the same software under different licensing conditions.

Autodesk also regularly changes the business models of the value added resellers (VARs) that sell its software. Over the years it has altered product margins, MDF (co-op market development funds), targets, incentives, promotions or execution. With each new amendment, it’s then down to the VAR to funnel their resources to try and meet the new goals.

For the last thirty plus years this magazine has witnessed this familiar dance between resellers and Autodesk. However, over the last seven years, with the internet and digital fulfilment, it’s become increasingly obvious that resellers have felt the squeeze like never before. Autodesk has been taking an increasing number of clients direct, while margins have been reduced.

Some VARs have responded by developing their own software, increasing their consultancy levels, banding together or acquiring other resellers to benefit from economies of scale. Some went out to get venture capital to create huge resellers than spanned the globe.

Last year in Australia and New Zealand, a region where Autodesk likes to test out changes to its business model, we heard that Autodesk was taking over the order processing of all the reseller deals. While the reseller would still actively manage the customer base and sell software services (SaaS) and their own services, Autodesk would take payment direct.

In February 2024 this was rolled out to the USA, and we hear it will happen in the UK next year. This represents a substantial change to Autodesk’s role within customer sales and will significantly alter the cashflows of VARs — especially the very large ones. It gives Autodesk insight into every deal, every discount and it benefits Autodesk from the positive cash flow of the sales of all its software, paying commissions back to the reseller.

It’s hard to predict the outcome of all of this but it would indicate that the street price of Autodesk products are set to move closer to the RRP and web prices that are available.

For resellers this may actually be a good thing, in terms of income, as Autodesk dealers competed mainly amongst themselves and discounted to the bone to win business. We’ve seen numbers quoted of $600 million given away in discounts by the channel.

Now that competition can’t be based on price, the large resellers that relied on that cash flow might struggle as the economy of scale is somewhat neutered. It also seems one step closer to the inevitability of Autodesk going fully direct. However, Autodesk’s applications are complex and there will always be a market for training, consultancy services and implementation, which Autodesk will not have the local resources to fulfil.

Autodesk’s three yearly Enterprise Business Agreements (EBAs) are for customers of a certain size, but this has been reducing in qualification of seat count / value of company for a while. In the future, EBAs might become the best way to get discounts, but they come with the constraint that they are notoriously hard to get out of. On leaving, all the software used would need to be repurchased at street price.

Some AEC firms decided that buying through resellers at discount and avoiding EBAs gave better flexibility. We think that these alternative routes will make less business sense as things progress.

While this is being presented as a change in process, it feels like the beginning of a change in business model and route to market. It’s like someone taking over driving a car in stages, as they swap seats. One has to wonder just what this will do to the number of resellers in the long term. At the recent Autodesk ‘One Team’ VAR Conference we hear there were some rather heated conversations.

Customers in the USA have had emails which ask them to set up Autodesk as a vendor on their internal procurement systems before their next purchase. Quotes and services are still handled by the reseller.

Autodesk states the benefits to customers will be a more ‘Personalised Service’, although, surely, this only applies to firms that never see their resellers in the flesh and a streamlined process with self-service tools to set up payment, subscription terms and renewals.

The other benefit mentioned by Autodesk is ‘Predictable pricing: enjoy consistent pricing, ensuring the best value for your investment’.

If, as we predict, street prices go up with no real route to negotiate, some customers may consider this plain cynical.

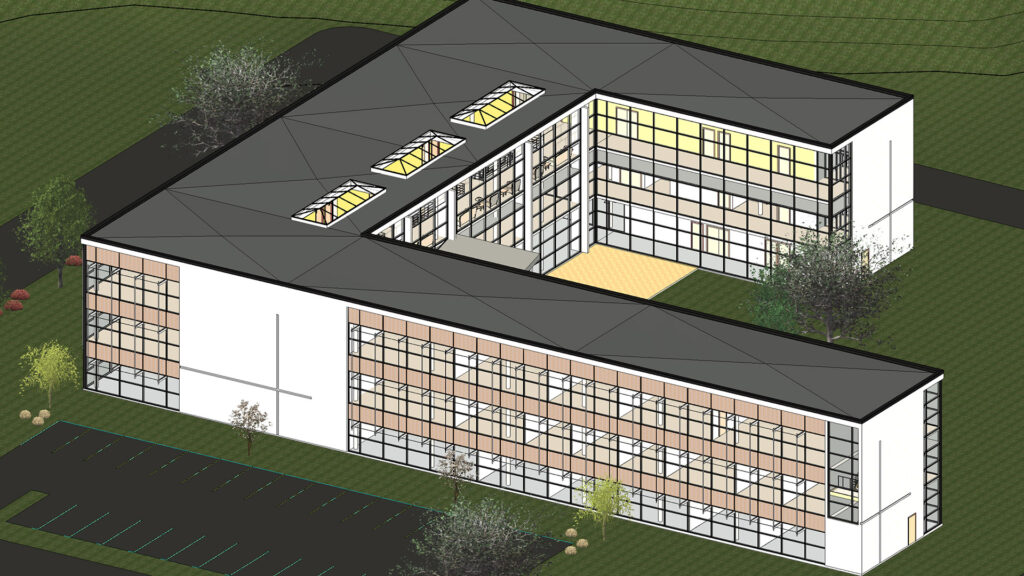

Main Image: Autodesk will soon collect direct payment from customers for software like Revit