It’s been a tough battle, taking the best part of two decades, but the world’s IT giants have finally woken up to the world of cloud-based collaboration for construction. By Paul Wilkinson

In 2017, cloud-based construction collaboration technologies finally hit the billion-dollar big time, with the December announcement that IT giant Oracle had offered a cool US$1.6 billion for Australian software-as-a-service (SaaS) vendor Aconex.

Once the deal closes, some time in the first half of 2018, Aconex will become part of Oracle’s cloud services portfolio and, more specifically, its construction and engineering global business unit. This is built around Oracle’s 2008 purchase of project portfolio management specialist Primavera and the 2016 acquisition of construction contracts and payment management provider Textura.

Aconex was founded in Melbourne, back in 2000 – one of many start-ups focusing on collaboration in construction launched around that time and one of the few to survive when the dotcom bubble burst.

In fact, the idea of managing documents and drawings online, so that they might be shared between team members, goes back even further. For example, Plantation, Florida-based eBuilder was founded in 1995, while Reading, UK-based GroupBC (formerly Business Collaborator) dates back to 1998.

Construction gets SaaS-y

Whether they survived or failed in the dotcom crash, these start-ups had tapped into a commonly expressed need in the construction industry: the need to collaborate. In other words, project delivery teams that were often fragmented, geographically dispersed, multi-disciplinary and multi-company needed better ways to manage design drawings, engineering specifications, contracts, photographs, change orders, requests for information and other documents that were increasingly being held in electronic formats.

So-called ‘project extranets’ allowed information to be loaded to secure, central repositories. From there, it could be accessed, viewed and downloaded, on a 24/7 basis, by authorised users and with all interactions captured in the form of an audit trail. Most of these extranet platforms were accessible via standard web browsers, with viewing tools and web-friendly file formats to avoid the need for proprietary software. A new extranet could be up and running quickly to support a new project and billed on a pay-as-you-go basis for the lifetime of the project, from its early conceptual stages to completion and handover.

The need among users to share design information online inevitably attracted the attention of AEC design authoring giants, as well as start-ups. Bentley Systems’ core collaboration product, ProjectWise, was launched in 1998, and was delivered as an on-premise, customer-hosted solution for most of its early history. Autodesk, meanwhile, was an early investor in spin-off company Buzzsaw.com, which it subsequently acquired in the wake of the dotcom crash in July 2001 and rebranded as Autodesk Buzzsaw.

In the UK, as well as Business Collaborator, so-called ‘pure play’ SaaS providers included 4Projects, Asite, BIW Technologies, BuildOnline and Cadweb, plus smaller players such as Collabor8Online, ePin, iSite and Sarcophagus. In Europe, there was Belgium’s BricsNet and Denmark’s Docia, as well as Germany’s Conject and Think Project, both based in Munich.

Inevitably, in an over-crowded market, consolidation takes its toll. The UK’s BIW Technologies was the market leader on home turf during the mid-2000s, but was fatally undermined by the global financial crisis of 2008. It was eventually acquired by Germany’s Conject, which in turn was acquired by Aconex.

Elsewhere, market consolidation saw 4Projects acquired by US enterprise resource planning (ERP) vendor Viewpoint; BuildOnline merged with some US SaaS vendors before being bought by France’s Sword Group and then sold to iDox-owned McLaren Software; Cadweb went bust. Germany’s RIB Software acquired Docia and Australia’s ProjectCentre.

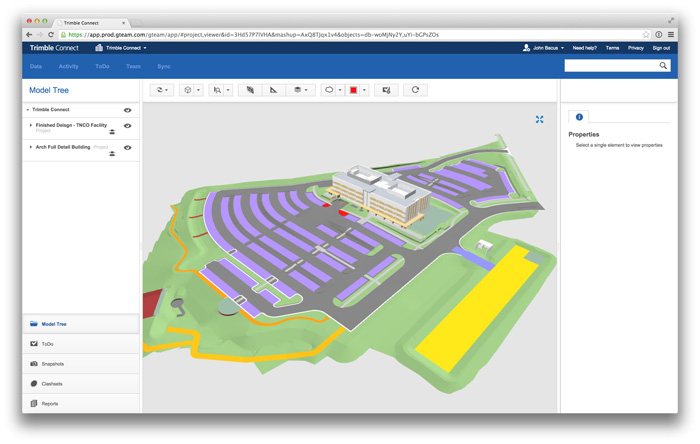

In the US, Autodesk bought US start-up Constructware in 2006, but this and Buzzsaw were gradually superseded by Autodesk’s BIM 360 product. Bentley ProjectWise began, slowly, to become an externally hosted SaaS product, as did Newforma; and Trimble built a SaaS collaboration portfolio, Trimble Connect, on the back of Meridian Systems (acquired in 2006), SketchUp (2012) and Gehry Technologies’ GTeam platform (2014). Meanwhile, Belgian CAD vendor Bricsys developed Chapoo, recently rebranded as Bricsys 247.

Functional diversification

But while there were plenty of vendor names for customers to consider during the early 2000s, the functional differences between the most commonly used file-sharing platforms were few and far between.

Most products essentially enabled collaboration, in the form of commenting and redlining of 2D documents and drawings, and supported some simple workflows.

Over time, vendors have differentiated as a means to woo customers with new features and capabilities. These include:

Online Health & Safety Files: BIW identified the laborious (and usually retrospective) compilation of project handover documentation as an opportunity, and created a module that helped users assemble project handover information incrementally during design and construction.

Security: Customers have always been anxious about the security, reliability and resilience of SaaS platforms, so vendors had to demonstrate compliance with standards such as BS7799. These days ISO27001 certification is usual, while Aconex is currently seeking approval under the US Federal Risk and Authorization Management Program, FedRAMP, so that customers can support US federal government projects with advanced security compliance requirements.

Project financial control: To meet the needs of a key customer, BIW also developed a project cost control module that helped contractors capture the real-time impacts of project changes.

Contract change management: Growing adoption of the NEC contract – conforming to the New Engineering Contract format championed by the Institute of Civil Engineers – also spurred competition between UK vendors. However, this is one area where specialist vendors, such as CEMAR (see box at bottom of page), have sought to create applications that complement, rather than compete with, platforms from cloud collaboration vendors. Equally, Aconex, US-based Procore and others are growing ‘ecosystems’ of partner solutions that plug in to their platforms.

Tendering: There has also been a rush to provide online support for issuing tender documents and receiving tender submissions; Asite’s platform, for example, includes extensive supplier spend management and procurement tools.

Mobile: Dramatic growth in the use of smartphones and tablets has seen a push to make SaaS platforms accessible from mobile devices. Some vendors developed solutions internally; others acquired mobile specialists. In 2014, for example, Viewpoint bought Mobile Computing Solutions and its Priority1 product, while Conject brought France’s Wapp6). At the same time, a new generation of mobile-first start-ups began to emerge (Basestone and Construction.pm in the UK, FieldLens and Plangrid in the US, and GenieBelt in Denmark are just a few examples).

Today’s BIM battleground

Meanwhile, BIM has also become a key SaaS battleground. Asite was one of the first companies to invest in BIM-related developments, while Viewpoint benefited from involvement in government-backed research initiatives, including the BIM Digital Toolkit.

The UK government’s BIM programme put online collaboration at the heart of its push in March 2011, when it was stated that a ‘data management server’ would be required to collect and process information. According to a government report of that time, this data management server should be: “available 24/7, reliable, secure and intuitive to use. Its appearance and operation is to be similar to that of one of the existing ‘collaboration’ systems currently available in the market. Indeed it may be that during the mobilisation period we may engage the existing service providers to enable such a service.”

As a result, SaaS construction collaboration platforms have evolved from what used to be electronic ‘common paper environments’ to meeting the demand for ‘common data environments’ (or CDEs), by enabling the sharing of 3D model-based information and workflows. (CDEs will be discussed in more detail in the March/April issue of AEC Magazine.)

In just a decade or so, then, the nature of software delivery in the AEC sector has changed profoundly with the emergence of the Cloud. IT departments no longer try to keep everything inside their firewall – savvy IT directors see the benefits of passing responsibility for data security and uptime to SaaS specialists, while AEC teams want sector-specific applications that will help them satisfy clients’ new digital demands.

As a result, the AEC sector is in midst of a digital transformation that is likely to be reflected in the AEC software sector, with new tools and cloud services emerging. Oracle’s big-money offer to Aconex, it seems, may just be the start of further rounds of investment and consolidation.

Contract change management

Increasing adoption of the NEC3 construction contract suite from 2005, both in the UK and internationally, saw extranet vendors and others rush to develop tools to manage and report on NEC3-related workflows including early warning notices, project manager’s instructions and compensation events.

4Projects and BIW were early leaders in this scramble, and in December 2010, both were appointed as licensed content partners by the NEC publisher, allowing them to incorporate NEC3 operational guidance into their applications.

However, this did not stop extranet rivals such as Asite, Aconex and Sword delivering contract change management modules as part of their wider platforms. UK contract specialists such as MPS, Sypro and Cemar also developed SaaS tools focused on the NEC suite.

The general interest in contract change management has also been good news for Cemar, where co-founder and CEO Ben Walker is also a member of the NEC’s drafting team for NEC3. Unlike many of the extranet providers, Cemar hasn’t diverted development resources to other emerging areas such as BIM or project cost control, but has instead remained true to its focus. Its strength in the contract change management area has led GroupBC to integrate Cemar’s workflow and reporting into its own common data environment, rather than try and compete with it.

Once logged in to Cemar, authorised users get a dashboard view of current projects, and can review key analytics about contract processes. While Cemar users might initially want to create notifications that resemble familiar paper-based correspondence (which it handles by way of PDF letter versions of all communications), Walker says they quickly gravitate towards viewing processes as events rather than as series of documents.

The analytics tools summarise recent and ongoing processes, while search tools can be used across processes to, for example, show the aggregated impact of weather events over time.

If you enjoyed this article, subscribe to AEC Magazine for FREE