This month Autodesk launched its first in-house developed P&ID (pipe and instrumentation diagram) application for AutoCAD. Martyn Day looks at the companyÝs aspirations for the Plant market.

Not that many years ago, Autodesk was a single product company. The companyÝs market dominating 2D CAD tool, AutoCAD, was both a platform for application developers to build niche tools on top of, as well as being an end in itself, replacing the drafting board.

While Autodesk concentrated on making the platform more powerful and feature-rich, the developers tailored AutoCAD to key vertical markets, adding functions that would be useful to the likes of mechanical engineers, electrical engineers, architects, civil engineers and plant designers to name but a few. Over the years this ecosystem grew and all profited, with some developers becoming major software developers in their own right, with their AutoCAD-based applications (DCA software, Eagle Point, Genius, EDA Autoplant, McNeel etc.)

Then Autodesk decided to ÙverticaliseÝ its development, which meant creating versions of AutoCAD to sell to specific engineering groups. New divisions were created in the company and Autodesk opted for Manufacturing, Building, Entertainment/Visualisation and Geospatial. The teams could either develop their own applications, or purchase existing applications – it was obviously quicker to get to market if Autodesk purchased the market leading applications in its key areas. In Building, Autodesk bought DCA software in the States and created Architectural Desktop (ADT), the mechanical division purchased a number of applications, which became Mechanical Desktop (MDT). This was bad news for the specific third-party developers that were now in competition with Autodesk, their own platform supplier.

So why am I taking you on a trip down memory lane? Well the notable exception in the verticalisation strategy was Plant Design. Even though there were a number of application developers building on top of AutoCAD at the time, companies like EDA AutoPlant, Autodesk didnÝt select to purchase any of them. At the time I do remember Autodesk helping its key two plant developers to agree terms to merge, providing some financial help. This may have been with a future purchase in mind but for some unknown reason, the successful new entity, called Rebis, ended up being acquired by one of AutodeskÝs main competitors, Bentley Systems in 2002. Now in 2007, Autodesk announces its ambitions to get into the Plant market, first with a P&ID application based on AutoCAD, which is now shipping and the company has a 3D system in development, both created from the ground up.

While Autodesk getting into a new vertical market is news in itself, itÝs interesting that the company feels that even after opting not to acquire its leading developer, it still thinks it can make a impact after so many years. According to company spokespeople, there are still a lot of vanilla AutoCAD and LT seats in P&ID design. By developing an intelligent symbol library, with intelligent pipe routing and bills of materials, Autodesk hopes to entice enough vanilla customers to upgrade and get good old fashioned productivity benefits. However, that appears to be just the first step, with a non-AutoCAD-based 3D solution coming in the future.

Being a late entrant to the market, the existing main players donÝt seem to be all that phased by AutodeskÝs latest move. Intergraph and especially Aviva seem to be co-operating with Autodesk. Aviva has even adopted AutoCAD P&ID as its base 2D package, to drive its mature 3D system. Bentley probably has the most to lose, as its AutoCAD-based Rebis installed-base is bound to come under some pressure. AutodeskÝs recent development of its own DGN translators, the core format of BentleyÝs MicroStation solution, are perhaps an indication of which vendor the company feels it is targeting.

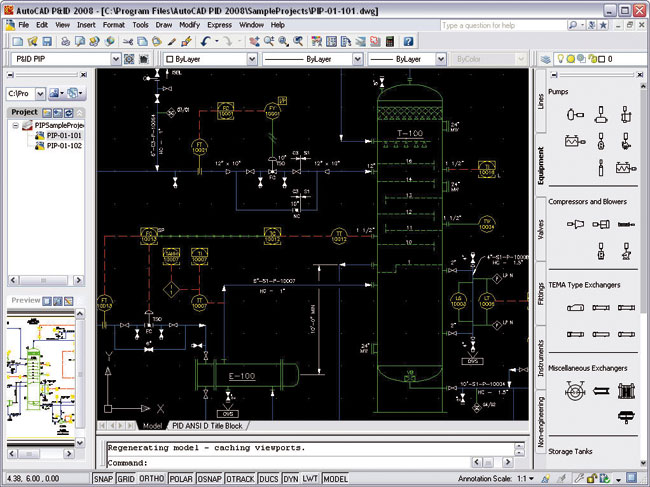

AutoCAD 2008 P&ID

Developed in less than a year, AutodeskÝs P&ID flavour of AutoCAD is a feature-rich and intelligent first release. Part of this is due to extensive beta testing in the USA and the fact that Autodesk started with a clean sheet. Developed using the ARX application development layer in AutoCAD, the object±based system lent itself well to the key requirements of a library-based system, while providing the familiar interface of AutoCAD.

There are some enhancements to the standard interface of AutoCAD but nothing that would cause any problems – in fact they give the user great feedback as to the state of the design. Autodesk is keen to point out that AutoCAD P&ID doesnÝt require a complex IT support department, which some Plant design systems do.

At the core of the P&ID system, lies a massive, intelligent Symbol Library. From the side menu, users simply drag and drop these symbols into the layout space. All symbols are intelligent and the Plant components automatically snap-to one another. The symbols conform to standards for PIP, ISO, and ISA. The AutoCAD P&ID components can be edited and moved using intuitive control grips. Components automatically align and snap into location when placed on process lines. When a process or signal line is moved or edited, components stick with the line, maintaining the right order, orientation, and relationship to the line. Users can customise and convert any group of geometric shapes or lines into distinct components or equipment to meet company standards. New symbols can be added to the project symbol library helping to ensure drawing consistency within the organisation. Substituting an existing symbol on a drawing with a new symbol of a similar type can be done with a single click.

Of course, to connect your components you need piping lines and AutoCAD P&ID offers dynamic connections which the same intuitive grip editing and manipulation that the components have. ItÝs easy to create, move, and snap lines into place. If you insert a component into an existing line, the line will automatically break and attach to components that are inserted on, or attached to, the line, as well as automatically mend when a component is removed. The lines intelligently re-route when connected equipment is moved, making complex layouts easy to arrange.

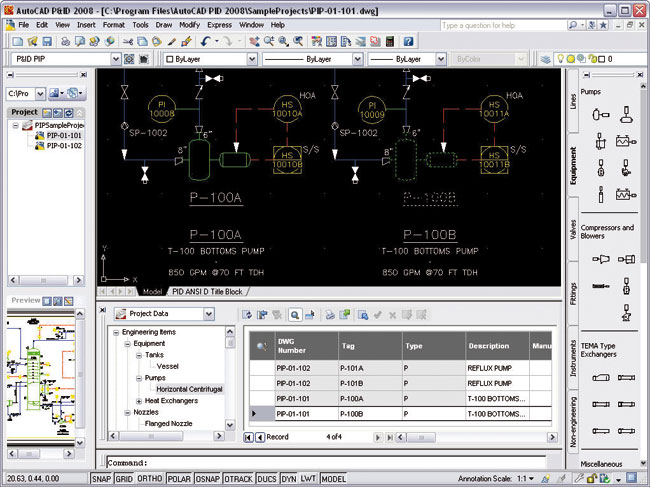

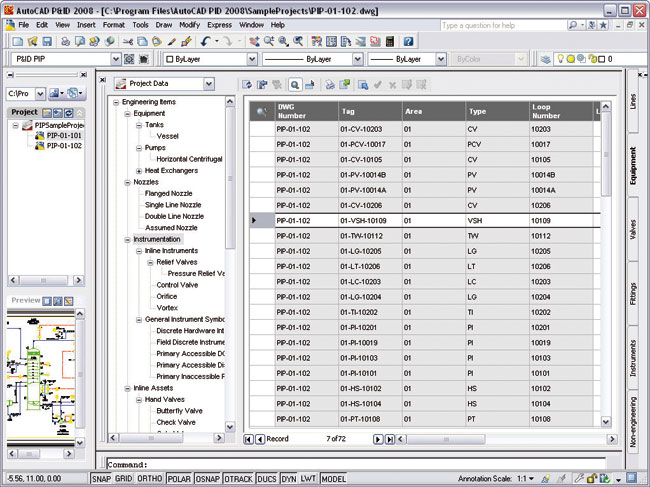

As you add objects to a drawing, AutoCAD P&ID maintains the uniqueness of the object across all drawings in the project. This is obviously pretty helpful and can be used prevent users from purchasing the same plant asset multiple times for the project by accident. All symbols and drawing elements have associated data properties which can be entered at any time. P&ID includes a useful Data Manager and Project Manager to set up projects, which may contain multiple drawings and provides the ability to track revisions and manage AutoCAD drawings. ItÝs also useful to use these to assess the impact of changes and edits.

With Excel being used extensively in the Plant industry, AutoCAD P&ID can import and export to Microsoft Excel. ItÝs possible to share drawing data with other teams by exporting the intelligent project data to Microsoft Excel, where it can be edited and then imported back in. The new updated information goes back the drawings. You can also electronically transmit P&ID drawing files containing embedded information without the need to query and filter data from a database. ThereÝs a powerful search and edit capability embedded into the spreadsheet interface. You can use the Data Manager to sort, filter, and find components in your P&ID drawings and quickly enter data properties specific to those objects. This is a great alternative way to browse project information and details. In this easy to use display, you can see Line numbers, component values, and other data. If you edit in the Data Manager, these are instantly updated in your P&ID drawings. ThereÝs also a cool ÙZoomingÝ feature within the Data Manager that instantly zooms your drawing window to the appropriate drawing object or record in the Data Manager.

{mospagebreak}

Conclusion

The value proposition of AutoCAD P&ID is a very simple and compelling one. If you use vanilla AutoCAD for P&ID layout this tool will save a massive amount of time. In many ways itÝs similar to AutoCAD Electrical, where vanilla AutoCAD is used extensively and the automation provided by AutodeskÝs vertical extension delivers great advantages.

It will be interesting to see how aggressively Autodesk goes after the Rebis installed-base. Autdoesk representatives talk about disenchanted Bentley customers that want a solution from Autodesk, not Bentley, or customers that are worried Bentley will move their application to MicroStation only. I guess time will tell. RebisÝ greatest asset is that it works both on top of MicroStation and AutoCAD for mixed environments.

Autodesk is expanding into new areas. Plant, although mature, is a growth area, that now appeals to the new management team of Autodesk CEO, Carl Bass. Above all, P&ID proves that itÝs never too late for Autodesk to get into a market and the companyÝs vast profits and share price means it can invest in product development and marketing. For now, Autodesk is happy to offer its own installed base a solid but basic P&ID solution but the companyÝs aspiration is to go far beyond that over successive years.